You can set up offset accounts to overhead and payroll for jobs to the employee's payroll department, which may or may not be the employee's home department. This allows more granularity and detail when employees perform work under a different payroll department.

Many companies set up payroll so that all employee wages and overhead burdens such as benefits, taxes, and tool costs charge to the Payroll departments such as electrical or excavation and these departments have managers that carry P&L responsibility. Jobs and service calls are assigned to divisions and may use resources from multiple departments.

As costs hit jobs, an offset account is credited, and a Cost of Goods Sold Account is debited so financial reporting can be done by division. Often, though, this offset is only at a company level instead of a Payroll department level, so department profitability can skew as a result. You can assign accounts at the department level, and further down at the pay code, overhead code, or cost element level. This is accomplished in one window: Payroll and Overhead Accounts Setup.

Example scenario: If a member of the Electrical department, in the Residential division, works on a Job in the Commercial division for 30 of 40 hours in a week, the costs of the member's benefits and tools costs for all 40 hours go to the Electrical department but 30 hours' worth of revenue is generated in the Commercial division. As a result, the division has profit, even with the Cost of Goods Sold amounts that it carries, and the Electrical department does not. If this happens often, financial reports can start to indicate that the Electrical department and even the Residential division is not contributing to profitability.

At minimum, you MUST assign an All - Default: REQUIRED account for each origin/account type combination in the account tree. However, this account would only be used if you did not have accounts assigned anywhere in the individual Division tree levels.

You can access the Payroll and Overhead Offset Accounts Setup in the following ways:

-

From the main menu, select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Payroll Offset Accounts.

-

In Service Management, from the Invoice Accounts window (Microsoft Dynamics GP > Tools > Service Management > Invoice Setup > Invoice Accounts > Payroll Offset button).

-

In Service Management, from the Maintenance Accounts window (Microsoft Dynamics GP > Tools > Service Management > Maintenance Setup > Accounts > Payroll Offset button).

About the Window Hierarchy

This window is organized in a hierarchical tree. There are main branches and sub-branches, like main folders and sub-folders in a Windows Explorer environment.

Origins represent the product areas: Job Cost, Service Invoice, and Service Maintenance.

Account Types represent the types of offset charges for which accounts will be assigned. These include Gross Pay Offset, Overhead Offset, Travel Offset, and Expense Offset.

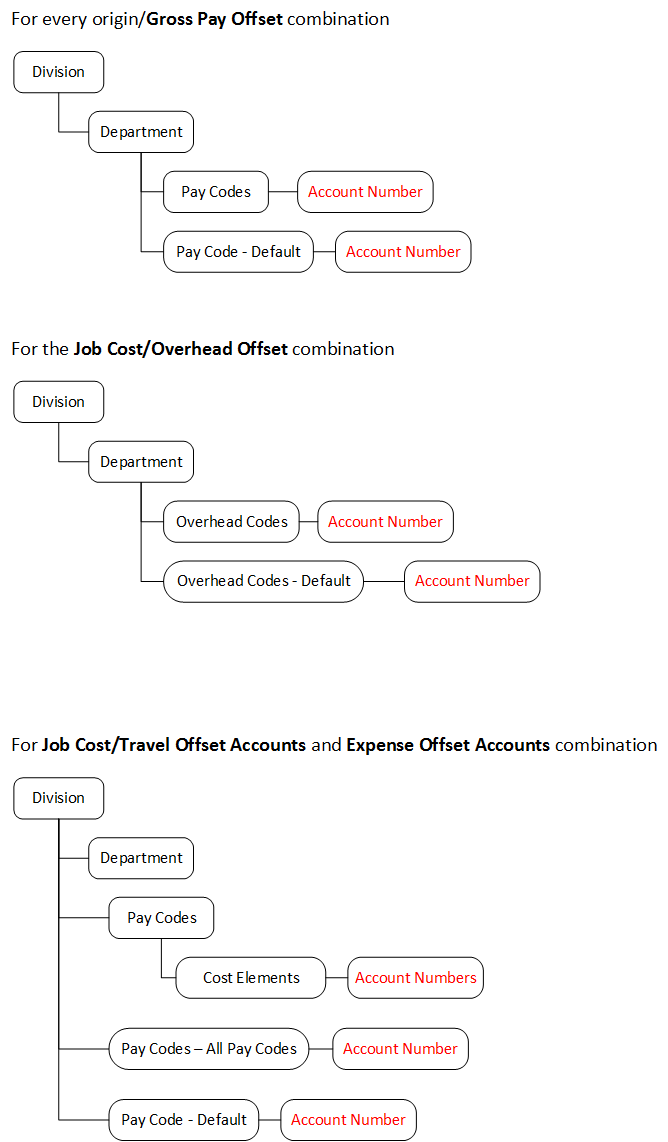

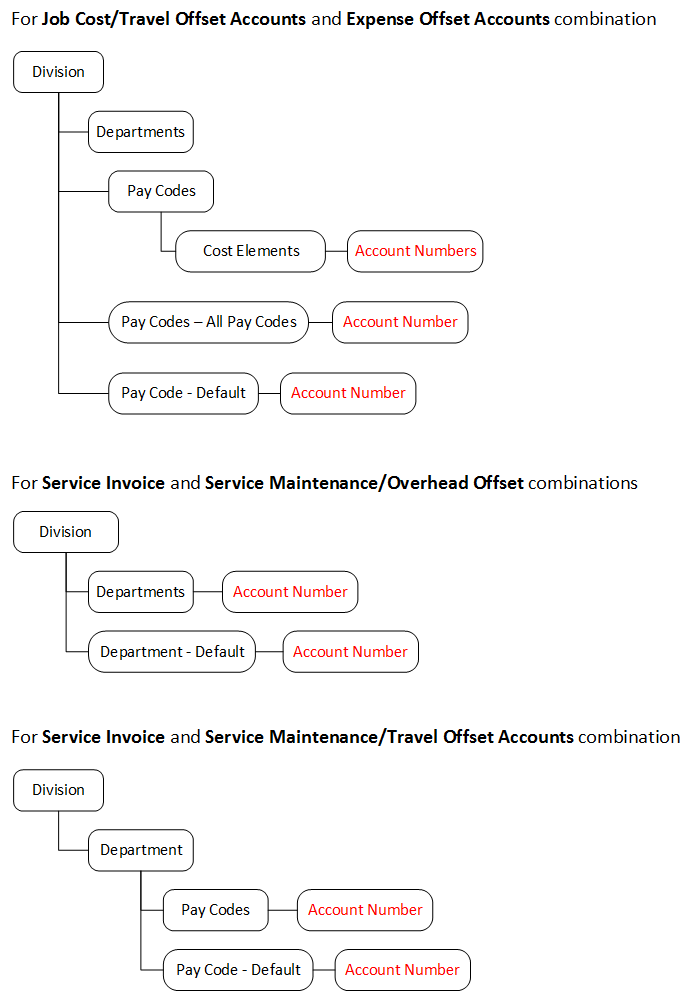

The highest level of the tree is Division; the next highest is Department. The next level depends on the origin/account type combination.

Each level contains a Default and All branch. Default is used when you want to assign a default account for that department, pay code, and so on, one is not needed at a lower level, such as per pay code, overhead code, or cost element. All is used when you know that there will be no specific accounts, and one account will suffice. Even the lowest levels within a hierarchy (Pay Code, Overhead Code, or Cost Element) have Default and All.

The ONLY required default account for the entire tree is the All - Default: REQUIRED account. You must assign a REQUIRED account for each origin/account type combination. However, this account would only be used if you did not have accounts assigned anywhere in the individual Division tree levels.

The hierarchy for each origin/account is illustrated below.

Preparing to Set up Accounts

The Payroll And Overhead Offset Accounts Setup window provides a lot of flexibility in setting up accounts. Before you begin assigning accounts, jot down how general or specific you want charges, expenses, and so on to be charged to what accounts, for which departments. Perhaps you could print the origin/account type diagrams above, and mark which levels for which you will assign accounts. If necessary, organize and enter your accounts in a spreadsheet, and use that as your source when you enter them into the system.

Setup Requirements for Account Types

Please review the following setup requirements for setting up offset accounts.

-

Overhead Offset

You can enter accounts for individual overhead detail codes (Job Cost) only if the Payroll Overhead Detail Distribution checkbox in the Posting Options window is marked. You can still assign a default account that would be used for all overhead codes. -

Travel Offset Accounts and Expense Offset Accounts

You can enter accounts for travel and expenses only if Signature TimeTrack is registered and the Create Expense/Travel Transactions option is set. This applies to all origins.

Printing the Account Setup List

To keep better track of which accounts were assigned, we recommend you periodically print the Signature Payroll and Offset Accounts list. In the Payroll and Overhead Offset Accounts window, select the printer button that displays at the bottom left of the window. Complete the Report Destination window to print the report.

If a setup option has been unmarked (for example, Create Expense/Travel Transactions in the TimeTrack Setup Options window) after an account was assigned in this tree that required the setting of that option, the account designation will still print in this report; however, the account cannot be posted to.

Assigning Accounts

You must set up at least a required default account for each origin/account type combination.

-

In the Payroll and Overhead Offset Accounts window, select the Origin and Account Type.

-

Locate the Division for which you want to assign accounts. Use the tree view to navigate as far down the tree as you desire, until you hit the level at which you want to assign an account. To save time, you can navigate the tree using arrow keys. When you get to a level/node where you can assign accounts, the account field at the bottom of the window is enabled. Some origin/account type trees do not go as deep as others. For example, for the travel offset account type, you can specify accounts at the Pay Code level. For the expense account type, you can assign accounts one level deeper, at the Cost Element level.

-

You can select an account in one of two ways:Double-click on the node to which you are assigning the account (ex. Pay Code). The Accounts window opens. Select an account, then click Select. The account displays in the account number in the account field. The account is saved automatically. - OR -Highlight the node in the tree, then enter the account manually in the account field at the bottom of the window. When finished, select the Save button. (You only need to select Save when you enter accounts manually.) Assign more accounts; remember to assign at least an All - Default: REQUIRED account for each origin/account type combination. If you close the window without having assigned Default accounts, a missing required account number message will display.

-

Select OK to disregard the error and keep the window open. You will get this message until you enter the required account that the system is looking for.

-

Select Ignore to close the window.

Creating New Accounts

Although you will probably not have to very often, you can create new accounts from the Payroll And Overhead Offset Accounts Setup window, that will be assigned to whatever node is selected.

-

Highlight the node in the tree, then enter the account manually in the account field at the bottom of the window.

-

In the account field, type a new account, then Tab. Select Add when prompted to create the account.

-

Select the type of account you want to create (Posting, Fixed, or Variable). The Account Maintenance window opens.

-

Complete the fields on the Account Maintenance window, including a Description. When finished, select Save.

How the System Determines Which Account to Use

When an offset account is needed in a posting window or elsewhere, the system looks at the Payroll and Overhead Offset Accounts Setup window, in the following order, starting from the lowest (more specific) level to the highest (more general).

-

(Specific) Pay Code, Overhead Code, or Cost Element

-

Pay Code - Default for Overhead Code or Cost Element - Default

-

Department - All Departments or Pay Code - All Pay Codes (for Job Cost travel and expense offset accounts only)

-

Department - Default

-

Division - All Divisions: Department (specific)

-

Division - All Divisions: Department - All Departments - Pay Code

-

All - Default: REQUIRED

Reviewing Accounts After Posting

In this section, we will look at a sample General Ledger after payroll has been posted, in this case, through the Signature Transaction Entry window. Included is where from within the Payroll and Overhead Offset Accounts Setup window the accounts were grabbed.

After running Signature Payroll Post, the posting journal report contains account information, including GL accounts and amounts. Below is a table of the accounts and windows/areas within Signature Job Cost from which the accounts were taken.

|

Area from Payroll and Overhead Offset Accounts Setup window |

Account |

Description |

Debit |

Credit |

|---|---|---|---|---|

|

Division Account Setup - COMMERCIAL Division - Labor Cost element |

000-1410-02 |

WIP-Labor-Jobs-COMMERCIAL |

$2100.00 |

$0.00 |

|

Payroll and Overhead Offset Account Setup - Gross Pay Offset Credit Account - HOUR pay code |

000-5100-00 |

Salaries and Wages |

0.00 |

1070.00 |

|

Payroll and Overhead Offset Account Setup - Overhead Offset Credit Account - HOUR pay code |

000-4801-00 |

Overhead Offset Job Cost Labor |

0.00 |

1036.00 |

|

Payroll and Overhead Offset Account Setup - Travel Offset Credit Account - TRAVEL pay code |

000-4800-00 |

Overhead |

0.00 |

3.80 |

|

|

|

Totals |

$2100.00 |

$2100.00 |