Setting up posting account information determines how Job Cost transactions post within Microsoft Dynamics GP General Ledger.

Setting up accounts involves the following, set up in the order displayed:

/*<![CDATA[*/ div.rbtoc1772637502487 {padding: 0px;} div.rbtoc1772637502487 ul {list-style: disc;margin-left: 0px;} div.rbtoc1772637502487 li {margin-left: 0px;padding-left: 0px;} /*]]>*/ Setting up Divisions Setting up Division Accounts Setting up Payroll and Overhead Offset Accounts Setting up Revenue Accounts Setting up Invoice Accounts Assigning Default Master Cost Codes Setting up Overhead Accounts (Optional)

Setting up Divisions

You can set up divisions to group jobs for reporting and accounting purposes. You can also attribute all job-related revenue and expenses to general ledger accounts set up for the division.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Divisions.

-

Enter a Division name. If you do not plan to use company divisions, select All.

-

Select Save.

-

To print the Division Setup list, select File > Print or select the printer button.

Setting up Division Accounts

You must define a posting account for each cost element. If your company uses multiple divisions, you must assign a default set of cost element posting accounts for each division.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Division Accounts.

-

Select a Division. You must set up accounts for all divisions.

-

Enter account numbers. You must enter a general ledger account for all cost elements, even if you do not plan to use them. If you are adding a new account, a message appears asking if you want to add this account. If you select Yes, another message appears asking what type of account you want to add. Select Posting, complete the Account Maintenance window, and select Save.

-

Select Save.

If you change accounts, the new account number takes effect for all new transactions posted to this division and cost element. Any unposted transactions saved to a batch before you changed the division account will post with the account number at the time of data entry.

-

To print the Division Accounts report, select Print. You can also print the Detail Codes List report to verify the debit general ledger posting accounts for a job's cost codes. See the Job Cost Dexterity Detail codes list report in the Reports manual or help file. Go to Help > Signature Manuals or Help > Signature Help.

Copying Division Accounts

You can copy an existing division and its accounts to save time. You must have marked the Payroll Overhead Detail Distribution checkbox during posting setup to copy overhead accounts. See Choosing Posting Options.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Divisions.

-

Enter a Division to copy.

-

Select Copy.

-

Enter the name of the new division in the Copy Division window.

-

Select Copy. The division is created, and the accounts are copied to the division. The new accounts are reflected in the following windows:Division Accounts SetupPayroll and Overhead Offset Account SetupRevenue Recognition Account SetupInvoice Accounts SetupDefault Cost Codes

Setting up Payroll and Overhead Offset Accounts

You can set up offset accounts to overhead and payroll for jobs to the employee's payroll department, which may or may not be the employee's home department. This allows more granularity and detail when employees perform work under a different payroll department. Many companies set up payroll so that all employee wages and overhead burdens such as benefits, taxes, and tool costs charge to the Payroll departments such as electrical or excavation and these departments have managers that carry P&L responsibility. Jobs and service calls are assigned to divisions and may use resources from multiple departments.

As costs hit jobs, an offset account is credited, and a Cost of Goods Sold Account is debited so financial reporting can be done by division. Often, though, this offset is only at a company level instead of a Payroll department level, so department profitability can skew as a result.

You can assign accounts at the department level, and further down at the pay code, overhead code, or cost element level. This is accomplished in one window: Payroll and Overhead Accounts Setup.

Example scenario: If a member of the Electrical department, in the Residential division, works on a Job in the Commercial division for 30 of 40 hours in a week, the costs of the member's benefits and tools costs for all 40 hours go to the Electrical department but 30 hours' worth of revenue is generated in the Commercial division. As a result, the division has profit, even with the Cost of Goods Sold amounts that it carries, and the Electrical department does not. If this happens often, financial reports can start to indicate that the Electrical department and even the Residential division is not contributing to profitability.

At a minimum, you MUST assign an All - Default: REQUIRED account for each origin/account type combination in the account tree. However, this account would only be used if you did not have accounts assigned anywhere in the individual Division tree levels.

You can access the Payroll and Overhead Offset Accounts Setup in the following ways:

-

From the main menu, select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Payroll Offset Accounts.

-

In Service Management, from the Invoice Accounts window (Microsoft Dynamics GP > Tools > Service Management > Invoice Setup > Invoice Accounts > Payroll Offset button).

-

In Service Management, from the Maintenance Accounts window (Microsoft Dynamics GP > Tools > Service Management > Maintenance Setup > Accounts > Payroll Offset button).

About the Window Hierarchy

This window is organized in a hierarchical tree. There are main branches and sub-branches, like main folders and sub-folders in a Windows Explorer environment.

Origins represent the product areas: Job Cost, Service Invoice, and Service Maintenance.

Account Types represent the types of offset charges for which accounts will be assigned. These include Gross Pay Offset, Overhead Offset, Travel Offset, and Expense Offset

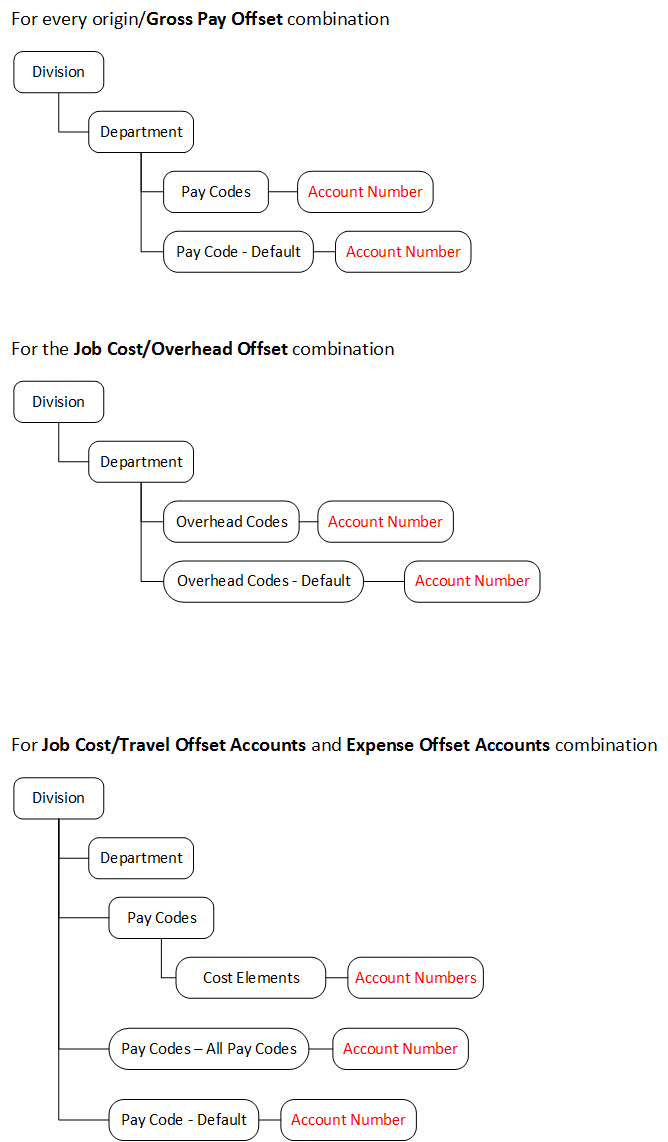

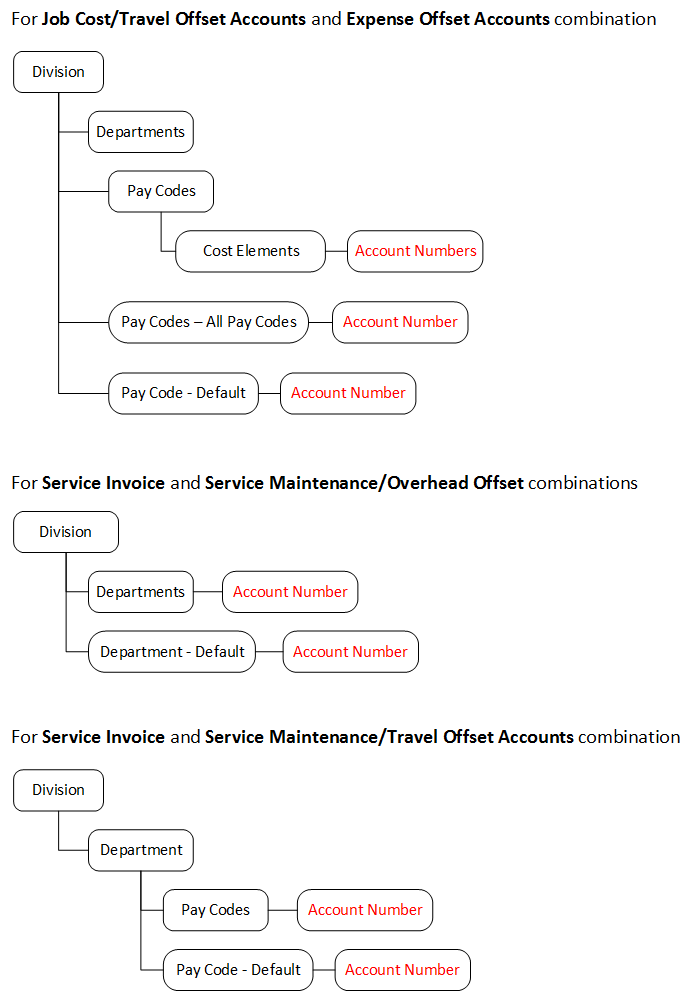

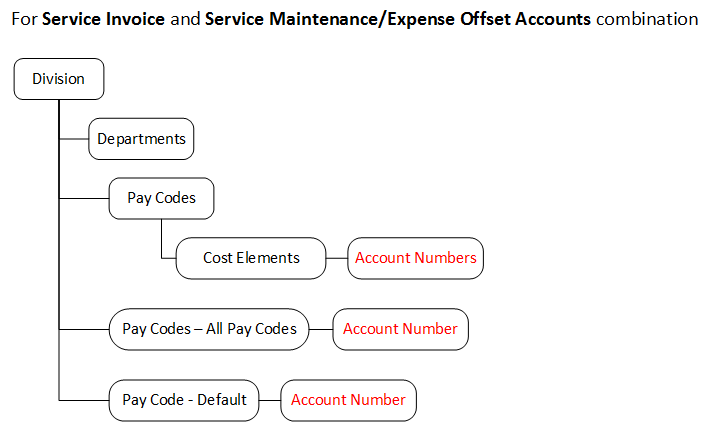

The highest level of the tree is Division; the next highest is Department. The next level depends on the origin/account type combination.

Each level contains a Default and All branch. Default is used when you want to assign a default account for that department, pay code, and so on, one is not needed at a lower level, such as per pay code, overhead code, or cost element. All is used when you know that there will be no specific accounts, and one account will suffice. Even the lowest levels within a hierarchy (Pay Code, Overhead Code, or Cost Element) have Default and All.

The ONLY required default account for the entire tree is the All - Default: REQUIRED account. You must assign a REQUIRED account for each origin/account type combination. However, this account would only be used if you did not have accounts assigned anywhere in the individual Division tree levels.

The hierarchy for each origin/account is illustrated below.

Preparing to Set up Accounts

The Payroll And Overhead Offset Accounts Setup window provides a lot of flexibility in setting up accounts. Before you begin assigning accounts, jot down how general or specific you want charges, expenses, and so on to be charged to what accounts, and for which departments. Perhaps you could print the origin/account type diagrams above, and mark which levels for which you will assign accounts. If necessary, organize and enter your accounts in a spreadsheet, and use that as your source when you enter them into the system.

Setup requirements for account types

Please review the following setup requirements for setting up offset accounts.

-

Overhead Offset

You can enter accounts for individual overhead detail codes (Job Cost) only if the Payroll Overhead Detail Distribution checkbox in the Posting Options window is marked. You can still assign a default account that would be used for all overhead codes. -

Travel Offset Accounts and Expense Offset Accounts

You can enter accounts for travel and expenses only if Signature TimeTrack is registered and the Create Expense/Travel Transactions option is set. This applies to all origins.

Printing the account setup list

To keep better track of which accounts were assigned, we recommend you periodically print the Signature Payroll and Offset Accounts list. In the Payroll and Overhead Offset Accounts window, select the printer button that appears at the bottom left of the window. Complete the Report Destination window to print the report.

If a setup option has been unmarked (for example, Create Expense/Travel Transactions in the TimeTrack Setup Options window) after an account was assigned in this tree that required the setting of that option, the account designation will still print in this report; however, the account cannot be posted to.

Assigning Accounts

You must set up at least a required default account for each origin/account type combination.

-

In the Payroll and Overhead Offset Accounts window, select the Origin and Account Type.

-

Locate the Division for which you want to assign accounts. Use the tree view to navigate as far down the tree as you desire, until you hit the level at which you want to assign an account. To save time, you can navigate the tree using arrow keys. When you get to a level/node for which you can assign accounts, the account field at the bottom of the window is enabled. Some origin/account type trees do not go as deep as others. For example, for the travel offset account type, you can specify accounts at the Pay Code level. For the expense account type, you can assign accounts one level deeper, at the Cost Element level.

-

You can select an account in one of two ways:Double-click on the node to which you are assigning the account (ex. Pay Code). The Accounts window opens. Select an account, then click Select. The account displays in the account number in the account field. The account is saved automatically. - OR -Highlight the node in the tree, then enter the account manually in the account field at the bottom of the window. When finished, select the Save button. (You only need to select Save when you enter accounts manually.) Assign more accounts; remember to assign at least an All - Default: REQUIRED account for each origin/account type combination. If you close the window without having assigned Default accounts, a missing required account number message will display.

-

Select OK to disregard the error and keep the window open. You will get this message until you enter the required account that the system is looking for.

-

Select Ignore to close the window.

Creating New Accounts

Although you will probably not have to very often, you can create new accounts from the Payroll And Overhead Offset Accounts Setup window, which will be assigned to whatever node is selected.

-

Highlight the node in the tree, then enter the account manually in the account field at the bottom of the window.

-

In the account field, type a new account, then Tab. Select Add when prompted to create the account.

-

Select the type of account you want to create (Posting, Fixed, or Variable). The Account Maintenance window opens.

-

Complete the fields on the Account Maintenance window, including a Description. When finished, select Save.

How the System Determines Which Account to Use

When an offset account is needed in a posting window or elsewhere, the system looks at the Payroll and Overhead Offset Accounts Setup window, in the following order, starting from the lowest (more specific) level to the highest (more general).

-

(Specific) Pay Code, Overhead Code, or Cost Element

-

Pay Code - Default for Overhead Code or Cost Element - Default

-

Department - All Departments or Pay Code - All Pay Codes (for Job Cost travel and expense offset accounts only)

-

Department - Default

-

Division - All Divisions: Department (specific)

-

Division - All Divisions: Department - All Departments - Pay Code

-

All - Default: REQUIRED

Reviewing Accounts after Posting

In this section, we will look at a sample General Ledger after payroll has been posted, in this case, through the Signature Transaction Entry window. Included is where from within the Payroll and Overhead Offset Accounts Setup window the accounts were grabbed.

After running the Signature Payroll Post, the posting journal report contains account information, including GL accounts and amounts. Below is a table of the accounts and windows/areas within Signature Job Cost from which the accounts were taken.

|

Area from Payroll and Overhead Offset Accounts Setup window |

Account |

Description |

Debit |

Credit |

|---|---|---|---|---|

|

Division Account Setup - COMMERCIAL Division - Labor Cost element |

000-1410-02 |

WIP-Labor-Jobs-COMMERCIAL |

$2100.00 |

$0.00 |

|

Payroll and Overhead Offset Account Setup - Gross Pay Offset Credit Account - HOUR pay code |

000-5100-00 |

Salaries and Wages |

0.00 |

1070.00 |

|

Payroll and Overhead Offset Account Setup - Overhead Offset Credit Account - HOUR pay code |

000-4801-00 |

Overhead Offset Job Cost Labor |

0.00 |

1036.00 |

|

Payroll and Overhead Offset Account Setup - Travel Offset Credit Account - TRAVEL pay code |

000-4800-00 |

Overhead |

0.00 |

3.80 |

|

|

|

Totals |

$2100.00 |

$2100.00 |

Setting up Revenue Accounts

You must designate the posting accounts that update when you create a percentage-of-completion journal entry or closing jobs journal entry for each division.

Even if you do not use the percentage-of-completion revenue recognition method, you must complete the revenue recognition account setup to specify payroll and payroll overhead offset accounts.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Revenue Accounts.

-

Select a division from the drop-down list, then select a Source Document.

-

Select accounts for the following categories. You must assign an account number to each revenue recognition account.Progress BillingsCustomer billings post to this general ledger account, which debits during the creation of revenue recognition entries for customer billings and should be the same account entered in the Invoice Account Setup window for each division.WIP accountsEnter WIP accounts for each cost element. These nine accounts will be the credit accounts in the percentage-of-completion journal entry for the various cost elements. If you are using percentage-of-completion or completed contract revenue recognition, these accounts should be the same as those entered in the Division Accounts Setup window.Billings in Excess of Cost + EarningsThe posting account to which amounts post for jobs with amounts billed greater than revenue earned on the job (in excess of cost plus earnings).Unbilled ReceivableThe posting account to which amounts post for jobs with amounts billed less than the revenue earned on a job (unbilled receivables).Prior Year Retained Earnings OffsetEnter the prior year retained earnings offset. This account is not used at the present time, but you must still enter an account for each division.

-

Select Save.

-

To print the Job Cost Revenue Accounts report, select Print. This report contains all the accounts you designate for revenue recognition.

Assigning Revenue and Expense Accounts

You must assign revenue and expense accounts that will be used as offset posting accounts for the WIP accounts selected in the Revenue Recognition Account Setup window.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Revenue Accounts. The Revenue Recognition Account Setup window opens.

-

Select the Revenue and Exp Accounts button.

-

Select accounts for the following categories:Contract EarnedThe contract earned account, which is the posting account to which revenue amounts for open jobs post when the percentage-of-completion journal entry is created. Typically, this is a sales-open jobs account.EXP accountsEnter expense accounts (EXP) that are debit offsets to the accounts entered in the WIP fields in the Revenue Recognition Account Setup window during the percentage-of-completion journal entry.

-

Select Save.

Setting up Accounts for Closing Jobs

If you use the percentage-of-completion revenue recognition method and post costs to WIP balance sheet accounts rather than expense accounts, the totals will be moved from the balance sheet to the profit-and-loss statement when you close the job. The accounts you set up in this section are updated with those totals when the job closes.

Enter a close jobs account for each editable field that is updated when you complete the job closing process. You must enter accounts for all items in the Close Jobs Account Setup window.

We recommend that you use the same accounts for closing jobs as you do for revenue recognition.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Setup > Account Setup > Revenue Accounts.

-

Select the Close Jobs Accounts button. The progress billings account and WIP accounts you entered in the Revenue Recognition Accounts Setup window automatically appear as defaults in the Close Jobs Account Setup window. You cannot change those accounts.

-

In the Contract Earned Closed Jobs field, enter the contract earned closed jobs account. Closed job revenues post to this account as the offset to progress billings accounts.

-

Enter expense accounts. The accounts entered will be debit offsets to the accounts entered in the WIP fields in the Revenue Recognition Account Setup window during the close job journal entry.

-

Select Save.

-

To print the Closed Jobs Accounts report, select Print.

Setting up Invoice Accounts

You must specify general ledger posting accounts, which are updated when you post job-related invoices. You can select to use a single sales general ledger account when posting Job Cost invoices (required for percentage-of-completion and completed contract revenue recognition methods) or assign a sales account to each cost element billed on an invoice. Assigning a sales account to each cost element allows you to track invoiced amounts by cost element in the general ledger.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Invoice Accounts.

-

Select a division from the drop-down list.

The invoice posting accounts are updated when you post invoices for a job assigned to this division. You must enter accounts for each division.

-

Select an invoice posting option and the appropriate general ledger posting accounts based on the invoice posting option you selected:

Option 1 - Single sales account

Option 2 - Sales account for each cost element/code

Select this option if...

You use the percentage-of-completion or completed contract revenue recognition method.

The single sales account method designates that one general ledger account updates when you post Job Cost invoices to the selected division.When an invoice is posted with this option, the typical general ledger entry debits an accounts receivable account and credits a progress billings account.

You want to update designated sales posting accounts assigned to each cost element when you post Job Cost invoices to the selected division.

Typically, you use this method to recognize revenue when issuing invoices. This option allows you to compare amounts billed for each cost element. For example, if you want to know the total amount of labor sales, all labor sales amounts are posted to one general ledger account. Each sale from a cost element posts to its specific account.

You cannot select option 2 if you are using the percentage-of-completion revenue recognition method.

Sales account to use when posting Job Cost invoices

Progress Billings

Enter the general ledger account credited when invoices are posted for jobs. This is for percentage-of-completion or closed jobs journal entries. This account is the offset to the progress billings account and should be the same as the account entered in the Division Accounts Setup window (Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Division Accounts).You can enter one sales account if you recognize revenue when invoices post and you want all sales amounts posted to the same general ledger account.

Cost Element Sales Accounts

Enter a sales account for each cost element. These accounts are updated for each cost element affected by an invoice:-

Labor

-

Materials/Equip

-

User-Defined 2

-

Subcontractors

-

Travel

-

Startup

-

Other

-

User-Defined 7

-

User-Defined 8

-

-

Enter receivables and commission accounts:Accounts receivableThe general ledger account debited when you post accounts receivable amounts for Job Cost invoices.Retention accounts receivableThe general ledger account debited when you post retention accounts receivable amounts for Job Cost invoices.Commissions payableThe general ledger account credited when you post commissions payable amounts for Job Cost invoices. Your setup selections in Receivables Management determine commission amounts.Commissions expenseThe general ledger account debited when you post commissions expense amounts for Job Cost invoices.

-

Mark the Use a sales account for each bill code checkbox if you want to use a sales account for each bill code at the job level and during job invoice entry. You cannot use this option if there are unposted invoices.

-

Select Save.

-

To print the Invoice Accounts report, select Print.

Assigning Default Master Cost Codes

If you use Payables Management with Job Cost, you can assign master cost codes that appear as defaults for specific distribution types when you enter Job Cost accounts payable transactions. These distribution types include trade discounts, freight, miscellaneous, tax amounts, and depreciation.

When you assign a master cost code as the default for a payables distribution type, costs automatically distribute to the cost code during transaction entry after you select a job number, provided the master cost code exists for the job. The costs then post to the general ledger account assigned to the Job Cost code.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Default Cost Codes.

-

Select a division from the drop-down list.

-

Mark the appropriate distribution types checkboxes. As you mark the checkboxes, the Cost Code Number field becomes enabled. You do not need to use all distribution types. By assigning a cost code number in the Depreciation field, the Fixed Assets Management depreciation expense account is credited, and the Job Cost general ledger account is debited upon posting. The asset must be set up as a job with the asset ID being the job number. The asset ID must also have a suffix of 1. The Depreciation field is enabled only if the Fixed Assets Management module is installed.

-

Assign a Cost Code Number and general ledger account to each distribution type.

-

Select Save.

-

To print the Default Cost Codes report, select Print.

Setting up Overhead Accounts (Optional)

If you selected the Payroll Overhead Detail Distribution option when you set up posting options (Microsoft Dynamics GP > Tools > Setup > Job Cost > Job Cost Setup > Posting Options), you must set up overhead accounts. An overhead detail account must be assigned for each division and each overhead detail code. Based on this setup, the posting process calculates each individual overhead detail cost amount and distributes that cost to a separate general ledger account.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Account Setup > Overhead Accounts.

-

Enter a Division.

-

Enter the Overhead Detail Code and Overhead Detail Account.

-

Select Save.

-

To print the Overhead Detail Accounts report, select File > Print or select the printer button.