Set up Job Cost payroll in the following order.

Overview of Overhead Codes

Overhead is the indirect, job-related cost your company incurs in the process of doing business. Examples of overhead costs are workmen's compensation and benefits earned by hourly employees. Overhead may also include items such as administrative salaries, rent expense, and other indirect expenses incurred in a job.

Job Cost allows you to recognize the overhead cost of labor by creating overhead detail codes and assigning those codes to overhead groups. The overhead groups are associated with position/department codes, which are associated with employees. The employee and job are entered in the payroll transaction. After a transaction is posted, the overhead is applied to the job.

Overhead Detail Codes

Overhead detail codes define how overhead amounts are calculated based on payroll costs. You can recognize indirect labor costs, not typically set up as cost codes on an hourly or piecework basis, as overhead. These costs are added to posted amounts for the detail and are not identified separately on customer invoices.

For example, assume you employ a technician, JBLACK, who works 10 hours at $10 per hour. If you set up a fixed cost overhead detail code of $5 per hour to account for benefits and a fixed cost overhead detail of 20 percent for general overhead, JBLACK's job wage calculation is:

|

10 hours @ $10 per hours |

$100.00 |

|

Overhead detail-benefits |

$50.00 ($5 x 10 hours) |

|

Overhead detail-general |

$20.00 ($100 x 20%) |

|

Job Wages |

$170.00 |

In this example, you would enter two overhead detail codes: one for benefits and one for general. You could use the abbreviation code BEN for the description "Benefit" and use $5 for the fixed portion. You could also use the code GEN for the description "General Overhead" and 20 percent as the portion.

The payroll transaction posts in Job Cost and then in the general ledger, provided the accounts are the default general ledger accounts, as a debit to WIP-Labor, a credit to the Wages Payable account of $100, and a credit to the Overhead Offset account of $70. The Wages Payable and Overhead Offset posting accounts default by division from the Revenue and Exp Account Setup window.

The methods for calculating overhead are flexible. You can allocate overhead on a cost-per-unit basis to a labor cost code or as a percentage of cost, or a combination of both.

You must set up detail codes for overhead in Job Cost regardless if you apply overhead to your jobs. To do so, create an overhead detail code for zero percent or zero dollars per unit.

Overhead Group Codes

Overhead group codes organize overhead detail codes logically per departments, positions, and pay codes. For example, assume you set up detail codes for hourly workmen's compensation overhead and hourly driving time to a site. You combine these details under a group code named Hour and specify that the code applies to technicians assigned to the installation department.

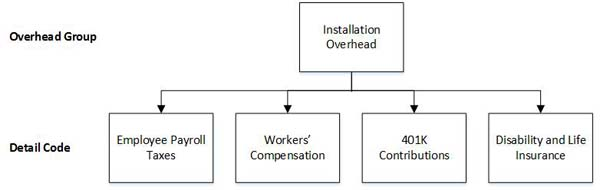

The following illustration shows how overhead details can be grouped:

Each detail code represents an indirect cost. You could enter the percentage of wages incurred on each of the details and use the appropriate amounts to calculate and track overhead costs on Job Cost payroll transactions assigned to the installation group code.

Grouping detail codes allows you to use both percentages and fixed amounts when calculating specific overhead amounts.

To post payroll transactions, you must set up at least one overhead group. Even if your company does not assign overhead costs to jobs, you must create an overhead detail code for zero percent or zero dollars per unit. You then assign the code to overhead group codes for each job department/position combination. See Setting up Overhead Group Codes.

See also: