You can implement prevailing wage and fringe rates into your payroll calculations, based on the information from the government-supplied Davis-Bacon Act (DBA) wage determination sheet. This information is based on the union, county and occupational code (fed class code) and includes standard, and overtime rates for wage and fringe benefits. You might have several different classes of workers on the same Davis-Bacon job (pipefitters, boilermakers, and so on). Each class of employee must be paid their appropriate determination. The actual wages plus employer-funded fringe benefits must equal or exceed the prevailing wage plus the prevailing fringe benefit amount equal or greater than the prevailing wage plus the fringe benefit amount - on an hourly basis (union or non-union) - as the base rate.

If an employee is due a cash fringe amount, which is paid in cash instead of contributing to the fringe benefit fund, the system calculates that amount and adds it to the employee's total hourly wage.

This feature accommodates several prevailing wage and benefit scenarios, including the following:

-

Prevailing wage is higher than employee standard wage.

-

Employee standard wage is higher than prevailing wage.

-

Prevailing fringe is higher than employee standard fringe.

-

Employee standard fringe is higher than prevailing fringe.

-

Prevailing wage is higher than employee standard wage but employee standard fringe is higher than prevailing fringe.

-

Prevailing fringe is higher than employee standard fringe but employee standard wage is higher than prevailing wage.

An excess in either component (wage or fringe) can offset a shortfall in the other component under the Davis-Bacon Act.

/*<![CDATA[*/ div.rbtoc1772210207049 {padding: 0px;} div.rbtoc1772210207049 ul {list-style: disc;margin-left: 0px;} div.rbtoc1772210207049 li {margin-left: 0px;padding-left: 0px;} /*]]>*/ About Prevailing Feature and Rate Classes Calculation Flow: Pay Rate with Cash Fringe Example Scenarios - Prevailing Wage and Benefits EXAMPLE 1: Prevailing Wage and Fringe Are Greater than Employee Standard Wage and Fringe EXAMPLE 2: Prevailing Wage Is Greater than Employee Standard Wage; Employee Fringe Is Greater than Prevailing Fringe, by a Greater Difference than the Wage Difference EXAMPLE 3: Employee Wage Is Greater than Prevailing Wage; Prevailing Fringe Is Greater than Employee Standard Fringe EXAMPLE 4: Employee Standard Wage and Fringe Are Higher than Prevailing Wage and Fringe, Respectively EXAMPLE 5: Employee Standard Wage Is Lower than Prevailing Wage, but the Employee Fringe Is Higher than the Prevailing Fringe Setup Prevailing Wage and Fringe Rate Maintenance Window Employee Fringe Maintenance Window

About Prevailing Feature and Rate Classes

If you also set up pay rates that are higher than DBA prevailing wage rates within a federal class code, but separated by position code, you can still use the rate class feature to set up rates by position, and the prevailing feature to set up the prevailing wage. The system simply takes the higher pay rate. Either way, rate classes are required to take advantage of the prevailing wage and fringe features, whether union or non-union.

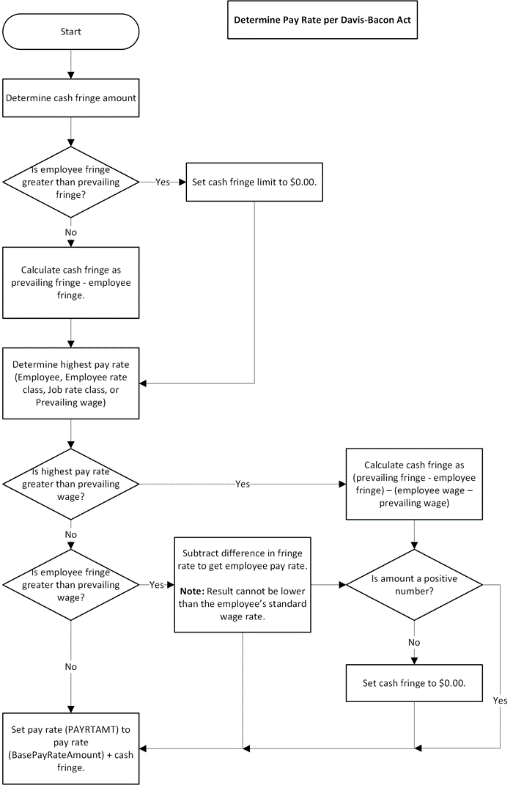

Calculation Flow: Pay Rate with Cash Fringe

The following diagram shows how the system calculates the pay rate involving prevailing wage and fringe amounts. Pay rate includes any cash fringe that may be due to the employee.

Example Scenarios - Prevailing Wage and Benefits

This section contains example scenarios to illustrate how prevailing wage and fringe benefits are calculated, including cash fringe, if applicable.

The Employee Standard rate in the examples below is the highest rate, taken from one of the following:

-

Employee (Employee Pay Code Maintenance window)

-

Employee rate class (Employee Maintenance Codes window)

-

Job rate class (Job Maintenance window)

EXAMPLE 1: Prevailing Wage and Fringe Are Greater than Employee Standard Wage and Fringe

In this example, the prevailing wage and fringe rates are higher than the bricklayer's standard wage and fringe. The bricklayer will get the prevailing wage of 32.71, plus the difference between the prevailing fringe and his/her standard fringe, making a cash fringe of 9.54.

|

|

Wage |

Fringe |

Cash fringe |

Total package |

|---|---|---|---|---|

|

Prevailing |

32.71 |

14.54 |

|

47.25 |

|

Employee Standard |

28.50 |

5.00 |

|

33.50 |

|

Result: |

32.71 |

5.00 |

9.54 |

47.25 |

Cash fringe = (prevailing wage - employee fringe)

EXAMPLE 2: Prevailing Wage Is Greater than Employee Standard Wage; Employee Fringe Is Greater than Prevailing Fringe, by a Greater Difference than the Wage Difference

In this example, the prevailing wage for bricklayers is greater than the employee's standard rate for bricklayers. However, the employee's fringe benefits are higher than prevailing. Because the difference in fringe is greater than the difference in wage (in the example below, $5.21 - $4.21 = $1.00), the employee does not get the prevailing wage, there is no cash fringe, and the wage rate is reduced from $32.71 to $31.71. The total package for the employee is $38.25, which is equal to the prevailing total package.

|

|

Wage |

Fringe |

Cash fringe |

Total package |

|---|---|---|---|---|

|

Prevailing |

32.71 |

4.54 |

|

37.25 |

|

Employee Standard |

28.50 |

9.75 |

|

38.25 |

|

Result: |

28.50 |

9.75 |

none |

38.25 |

EXAMPLE 3: Employee Wage Is Greater than Prevailing Wage; Prevailing Fringe Is Greater than Employee Standard Fringe

In this example, the prevailing wage for bricklayers is $25.75 per hour but your company has Bricklayer 1 and Bricklayer 2, where Bricklayer 1 makes 25.50 per hour and Bricklayer 2 makes 28.00 per hour. (You can set up the different rates using a combination of the prevailing feature with the rate class feature to set up the three rates). In our example, Bricklayer 2 is used, and since the employee rate is higher than the rate class rate, $28.00 will be used. The prevailing fringe rate is greater than the employee fringe. In this example, the difference in the wages ($2.25) is subtracted from the greater difference in fringe ($3.00), giving us a cash fringe of $0.75.

|

|

Wage |

Fringe |

Cash fringe |

Total package |

|---|---|---|---|---|

|

Prevailing |

25.75 |

8.00 |

|

33.75 |

|

Employee Standard |

28.00 |

5.00 |

|

33.00 |

|

Result: |

28.00 |

5.00 |

0.75 |

33.75 |

Cash fringe = (prevailing fringe - employee fringe)- (employee wage - prevailing wage)

EXAMPLE 4: Employee Standard Wage and Fringe Are Higher than Prevailing Wage and Fringe, Respectively

In this example, the bricklayer's standard wage and fringe are higher than the prevailing wage and fringe, respectively. Therefore, the total package for the employee is higher than the prevailing package, and no adjustments are necessary.

|

|

Wage |

Fringe |

Cash fringe |

Total package |

|---|---|---|---|---|

|

Prevailing |

25.75 |

5.00 |

|

30.75 |

|

Employee Standard |

28.75 |

8.00 |

|

36.75 |

|

Result: |

28.75 |

8.00 |

none |

36.75 |

EXAMPLE 5: Employee Standard Wage Is Lower than Prevailing Wage, but the Employee Fringe Is Higher than the Prevailing Fringe

In this example, the prevailing wage is $1.00 higher than the employee standard wage, and the employee fringe is $1.00 higher than the prevailing fringe. Therefore, the employee will not get the prevailing wage of $34.00 but instead, the standard rate of $33.00 (34-1). There is no cash fringe and the total package is $39.00.

|

|

Wage |

Fringe |

Cash fringe |

Total package |

|---|---|---|---|---|

|

Prevailing |

34.00 |

5.00 |

|

39.00 |

|

Employee Standard |

33.00 |

6.00 |

|

39.00 |

|

Result: |

33.00 |

6.00 |

(none) |

39.00 |

Setup

Setting up the prevailing wage and benefits feature involves the following windows: Employee Fringe Maintenance, Prevailing Wage and Fringe Rate, Rate Class Codes, and Rate Class Detail. Information on the rate class windows appears in the Job Cost User Manual. Make sure to set up rate class codes and detail before setting up prevailing wage and fringe rates.

Prevailing Wage and Fringe Rate Maintenance Window

This window is used to enter wage rate and fringe rate information from the government-supplied wage determination sheet. Information is based on the union, county and Standard Occupational Code (Fed Class Code). Fringe rate is an hourly accumulation of all the fringe benefits paid to a typical employee in a classification (union or non-union). Microsoft Dynamics GP > Tools > Setup > Job Cost > Payroll Setup > Prevailing Wage and Fringe Rate.

-

Rate Class

Select the rate class for which you will be entering wage and fringe rates. -

Union Code

This can be any union; it does not have to be assigned to the selected rate class in the Rate Class Detail window. This field is NOT required for non-union contractors. -

Start Date

Enter a starting date for entering wage and fringe rates in this window. The default is the user date. -

Filter Date

Use this field to filter the wage/fringe rate entries that appear in the window. Wage/fringe rate entries appear only if this Filter Date falls within the start and end dates of the entry. If there are multiple entries (rows) for the same federal classification, but with different start dates, only the most recent entry will appear, assuming the Filter Date falls within the date range of the entry. -

Federal Classification

Sometimes referred to as the Standard Occupational Code. -

Rates (straight time, overtime, and double time)

Enter the wage rate for straight time, as supplied on the wage determination sheet. The overtime and double time are calculated automatically; you can change these amounts, if necessary. -

Fringes (straight time, overtime, and double time)

Enter the fringe rates for straight time, overtime, and double time - as supplied on the wage determination sheet. This will be an accumulated amount of several benefit categories. The default for overtime and double time is the same as straight time, however, you can override these defaults. -

Start Date

The date that the wages for this federal classification code takes effect for this employee. -

End Date

The system automatically fills in an end date as soon as you create a subsequent entry for the same federal classification code with a different start date (you cannot enter a date manually). For example, if wages for a fed code go into effect on 1/10/2010, but will increase on 6/1/2010, as soon as you enter the wage line for 6/1/2010, the End Date for the previous entry will be set to a day before, in this case, 5/30/2010.

Entries are saved as soon as you enter data into a field. To delete a row of data, right-click and select Delete Row. Also, if the Filter Date does not fall completely within the start and end date of the new entry, the entry will disappear from view as soon as you tab to the next line. The line is saved, but won't appear until you change the Filter Date.

Employee Fringe Maintenance Window

This window is used to enter and manage fringe benefits paid to each employee, including a start (effective) date. The standard benefits entered in this window are compared to prevailing fringe benefits, based on the information from the government-supplied Davis-Bacon Act (DBA) wage determination sheet. Microsoft Dynamics GP > Tools > Setup > Job Cost > Payroll Setup> Employee Fringe

If you want the correct prevailing wage amount to default into Time Card Entry, you must set up at least one default benefit in this window, even if the fringe amount is zero.

-

Employee ID

This employee must be set up in the Employee Maintenance Code window in Job Cost. -

Name

Fills automatically based on employee ID. -

Start Date

Enter a starting date for entering fringe benefits. If no date is entered, today's date is used. -

Filter Date

Use this field to filter the fringe rates that appear in the window. Fringe benefits appear only if this Filter Date falls within the start and end dates of the benefit. -

Benefit

You can select existing benefits, one by one, using the lookup (same lookup accessed through the Payroll module) - OR - you can create one benefit that is an accumulation of the individual benefits for this employee. You can give your own name to this new benefit; it does not have to be an existing benefit name. If you select benefits individually, the system will add up the total automatically. If you already know the total benefit amount for this employee, you can create one new benefit name and enter the total in one line. -

Start Date

The date that the benefit takes effect for this employee. -

End Date

The system automatically fills in an end date as soon as you create a subsequent entry for the same benefit code with a different start date (you cannot enter a date manually). For example, if benefit code H&W goes into effect on 1/10/2010, and will increase on 6/1/2010, as soon as you enter the benefit line for 6/1/2010, the End Date for the previous entry will be set to a day before, in this case, 5/30/2010. -

Fringe (straight time, over time, and double time)

Enter the fringe rates for straight time, overtime, and double time - as supplied on the wage determination sheet. This can be an accumulated amount of several benefit categories (see Benefit above).

Entries are saved as soon as you enter data into a field. To delete a row of data, right-click in the row and select Delete Row. Also, if the Filter Date does not fall completely within the start and end date of the new entry, the entry will disappear from view as soon as you tab to the next line. The line is saved, but won't appear until you change the Filter Date.