Cost codes are used to define and categorize the costs of a job. Cost codes serve as the building blocks of job costing and allow you to define the source of posting accounts and the revenue recognition method used. Cost recognition in Job Cost consists of the cost code format or structure, cost code segments, cost codes, and cost code elements. In addition, you need to specify profit types (for Cost Plus contract and Cost Plus NTE contract jobs) and production measures that you can assign to cost codes.

Setting up cost codes involves the following, in the order displayed:

/*<![CDATA[*/ div.rbtoc1772210203044 {padding: 0px;} div.rbtoc1772210203044 ul {list-style: disc;margin-left: 0px;} div.rbtoc1772210203044 li {margin-left: 0px;padding-left: 0px;} /*]]>*/ Dividing a Job into Segments Setting up Cost Element Names Renaming Cost Code Segments Setting up the Cost Code Format Defining Production Measures Saving Predefined Profit Types Setting up Master Cost Codes

Dividing a Job into Segments

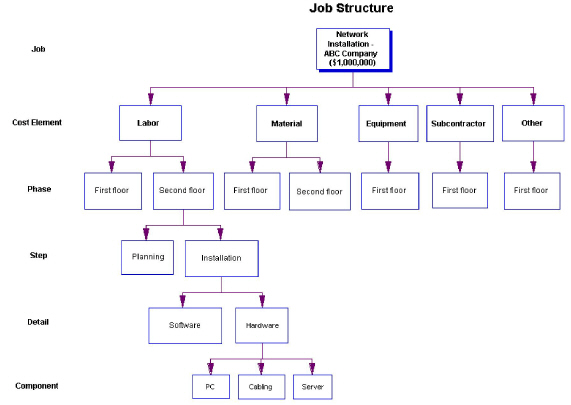

Large projects, activities, and organizations are often divided into smaller parts to facilitate their management. The following diagram shows how a job can be broken into cost elements and cost code segments (phases, steps, details, and components).

Setting up Cost Element Names

Cost elements are categories of costs on a typical job and are used to group similar costs or cost codes. Labor, Material, Equipment, Subcontractor, and Other serve as default cost elements. Four user-defined cost elements are also available.

You can accept the default cost element names or rename them. You cannot rename the Labor cost element because it is the only cost element used with payroll transactions. You should establish your cost elements before renaming your cost code segments

Below is a list of the default cost elements

|

Cost element |

Description |

|---|---|

|

1 - Labor |

You can post transactions that include the Labor cost element to Job Cost payroll or Microsoft Dynamics GP Payroll. You can also post labor costs with job transaction entries. |

|

2 - Material |

If you're using Inventory Control, you can post transactions that include the Material cost element to Job Cost and Inventory Control. You can also post material costs with job transaction entries or accounts payable transactions. |

|

3 - Equipment |

If you're using Payables Management, you can enter equipment costs on a voucher and post to the payables record for the vendor from which you rented the equipment. You can also post equipment costs with job transaction entries or inventory transactions. |

|

4 - Subcontractor |

If you're using Payables Management, you can post Transactions that include the Subcontractor cost element to Payables Management. You can also post subcontractor costs with job transaction entries or inventory transactions. |

|

5 - Other |

This cost element is used to track miscellaneous costs that do not fall into one of the four default cost elements. Examples are manually calculated overhead amounts and freight. You can also post Other cost elements with job transaction entries, accounts payable, or inventory transactions. |

|

6 to 9 -User-defined |

You can create up to four user-defined cost elements and define revenue and expense posting accounts. You can also post user-defined costs with job transaction entries, accounts payable, or inventory transactions. |

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Cost Code Setup > Cost Elements.

-

You can change the names of the default and user-defined cost element descriptions.

If you plan to modify any Job Cost reports using Report Writer, you must use the default name in the Internal Name column.

-

To print the Cost Element Setup List report, select File > Print or select the printer button.

-

Select Save.

Renaming Cost Code Segments

A segment represents a unique category of information, such as a business location, department, or account type. Default names for cost code segments are provided in the Cost Codes Segment Setup window. You can either save the default names or rename the segments to suit your needs.

If you rename a cost code segment, you must do so before setting up your cost code format.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Cost Code Setup > Cost Code Segments.

-

You can enter a new name for each cost code segment. For example, if you create cost codes and use the second segment to differentiate the cost codes by warehouse location, enter "location" instead of "phase."

-

Select Save.

-

To print the Cost Code Segments List report, reopen the Cost Code Segment Setup window, and select File > Print or select the printer button.

Setting up the Cost Code Format

The cost code format can contain one to four segments. Each segment can contain up to five alphanumeric characters. Each segment of a cost code represents a unique phase, step, detail, or component level of a job.

If you rename a segment, you must do so before setting up your cost code format.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Cost Code Setup > Cost Code Format.

-

In the Number of Segments field, enter the number of segments for your cost codes. This is determined by how you plan to break down your jobs. You can enter up to four segments and can enter a maximum of five alphanumeric characters for each segment. Do not leave blank characters in segments. You must enter at least one segment consisting of at least one character. You can use additional steps, details, and components. We do not recommend or support changing the format after you post costs.

-

Select Save.

If you need to use large segment lengths in your company, you may need to change your Microsoft Dynamics GP user preferences to allow scrolling arrows in your cost code fields. To change preferences, select Microsoft Dynamics GP > Tools > Setup > User Preferences. In the User Preferences window, mark the Horizontal Scroll Arrows checkbox.

If you want to change the cost code format after saving, you must contact WennSoft Support. We do not recommend or support changing the cost code format after costs post in Job Cost.

Defining Production Measures

Production measures are used to track the number of units estimated or produced for a selected cost code. Typical measures are Hours and Each.

You must set up production measures before you add cost codes to your jobs. This is necessary for assigning production and estimate measures to the cost codes. You can set up additional production measures in the Job Cost Codes Setup window.

A quantity-per-unit is calculated automatically for each cost code in the Job Cost Code Setup window. You can also compare actual production quantities for cost codes to estimated production quantities to help identify problems with a job.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Cost Code Setup > Measures.

-

Enter a Measure Code and Description.

-

Select Save.

-

To print the Production Measure Codes report, select File > Print or select the printer button.

Saving Predefined Profit Types

Profit types define billing amount calculations for cost codes. When you assign a profit type to a cost code, billing amounts on all posted job transactions for this cost code use the calculation method associated with the assigned profit type. If you select Cost Plus or Cost Plus NTE as a job's contract type, billing amounts calculate automatically as costs are posted to the job. These amounts are based on the profit types on the Profit Type Setup window.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Cost Code Setup > Profit Types.

-

Select Save.

You must open and save the Profit Type Setup window, even though you cannot change the defaults.

-

To print the Profit Type Setup List report, reopen the Profit Type Setup window, and select File > Print or select the printer button.

Description of Profit Types

-

1 - Non-billable

Billing amount = 0.00

Use this profit type when the cost amounts posted to the cost code for the job should not be billed to the customer, or if you want to track costs but not bill for costs. -

2 - None

Billing amount = cost amount

Use this profit type when the cost amount charged to the cost code for the job will become the billable amount. This is the default profit type for all cost codes on Fixed Amount contract jobs. -

3 - Percent margin

Billing amount = cost / (1 - percent margin)

Use this profit type when the billing amount is based on a desired profit margin for the cost code. This margin is assigned as the profit amount for the cost code. For example, if a unit's actual cost is $100, and you select a percent margin of 24 percent, the billing amount is $131.58. (The calculation is: 100 / (1 - 0.24) = 131.58). -

4 - Percent of cost

Billing amount = cost + (cost x percent of cost)

Use this profit type when the markup amount is calculated as a percentage of the actual cost for the cost code assigned to the job. This markup percent is assigned as the profit amount to the cost code. For example, if the actual cost for the cost code is $100, and you select a percent of cost of 10 percent, the billing amount is $110. -

5 - Per unit amount

Billing amount = cost + (number of units x profit per unit)

Use this profit type when the profit amount is calculated as a dollar amount per unit for the cost code. For example, if the cost of each unit is $10, and 10 units are used with a profit amount of $5 per unit, the billing amount is $150. (Cost is 10 x $10 = $100 and billing amount is $100 + ($10 x $5) = $150.) -

6 - Total dollar amount

Billing amount = cost + profit amount

Use this profit type when the profit amount for the cost code equals a total dollar amount, regardless of the cost or number of units used. For example, enter a profit amount of $100 for the cost code. The amount billed for the cost code is cost plus $100. -

7 - Flat rate per cost code

Use this profit type when the billing amount for the cost code equals a total dollar amount, regardless of the cost or number of units used. The total amount billed for the cost code is entered as the profit amount for the cost code. For example, enter $10 as the total amount billed for the cost code. If your cost is $7, your profit is $3. If your cost is $8.50, your profit is $1.50. -

8 - Flat rate per unit

Use this profit type when the cost code is billed as a flat amount per unit regardless of the cost of the unit. The amount billed per unit for the cost code is entered as the profit amount for the cost code. For example, if you enter a billable amount of $25 for a labor cost code, you bill $25 per unit. If your cost per unit is $10, your profit per unit is $15. If your cost per unit is $22.50, your profit per unit is $2.50. -

9 - Service labor rate group

If you are also using Service Management, use this profit type to bill job customers for labor-only cost codes and establish billing amounts for labor transactions. Labor rates can be set up to reflect different rates for different pay codes. You can create labor rates by position or by department. This profit type is unavailable if you do not have the Service Management Labor Rates module. Contact WennSoft Sales if you would like to purchase this module.

Setting up Master Cost Codes

Since the jobs a company performs are usually similar, many of the details of the job structure (including some cost codes) will be common to many jobs. Master cost codes are commonly used codes that can be easily assigned to jobs without re-entering information.

When designing cost codes, keep in mind that the system sorts characters from left to right, with numbers taking priority over letters.

-

Select Microsoft Dynamics GP > Tools > Setup > Job Cost > Cost Code Setup > Master Cost Codes.

-

Complete the following fields, as necessary.Cost Element TypeThe default is 1 for Labor.Cost Code, DescriptionEnter a new cost code and description.Profit Type ID, Profit AmountEnter the profit type ID and profit amount. If you only use the cost code on Cost Plus contract jobs, assign a profit type ID. The profit type for all cost codes assigned to Fixed Amount contract jobs automatically defaults to None and cannot be changed. If all jobs have the same profit amount for this cost code, you can set a percentage or currency profit amount.Service Labor Rate GroupEnter a service labor rate group. This field is enabled only if the profit type is 9 - Service Labor Rate Group. See Creating Labor Rate Groups for Job Cost (Optional).Estimate Units, Estimate Amount/Unit, Estimate Amount, Estimate Measure, Estimate Measure NameEnter estimate information. Generally, the estimate unit and estimate amount/unit are assigned at the job level. The Estimate Amount field fills in automatically. When you enter an estimate measure, the Estimate Measure Name field will complete.Production Est. Qty, Production Qty/Unit, Production Measure, Production Measure NameEnter production information. If all your jobs use the same production measures for this cost code, enter the production quantity needed to complete a typical job. The production quantity per unit is calculated automatically based on the Estimate Units field. Enter a production measure. The Production Measure Name field will complete.Transaction TypeEnter the transaction type. Accept All as the default or select from the drop-down list. Choices include ALL, Inventory Item, Vendor ID, and Purchase Order. If you select Inventory Item, an Item Number field appears, allowing you to enter an inventory item. If you select Vendor ID, you can enter a vendor as a subcontractor. See Adding subcontractors to a job record. If you select Purchase Order, a PO Number field appears. Enter a purchase order number.Workers CompUse the lookup button to select a workers' compensation code.Account NumberIf you selected the Cost Code option in the posting options setup, select a general ledger posting account to post transaction costs assigned to this cost code. When you assign a general ledger account to a cost code in the Master Cost Code Setup window, the designation remains in effect when you add the cost code to a job in the Job Cost Codes Setup window. If you selected the Division posting option, you would not be able to select an account in the Master Cost Codes Setup window. Instead, when you use the Job Cost Code window, a default account will appear, taken from your division account setup.

-

Select Save.

-

To print the Cost Code Master Setup report, select File > Print or select the printer button.