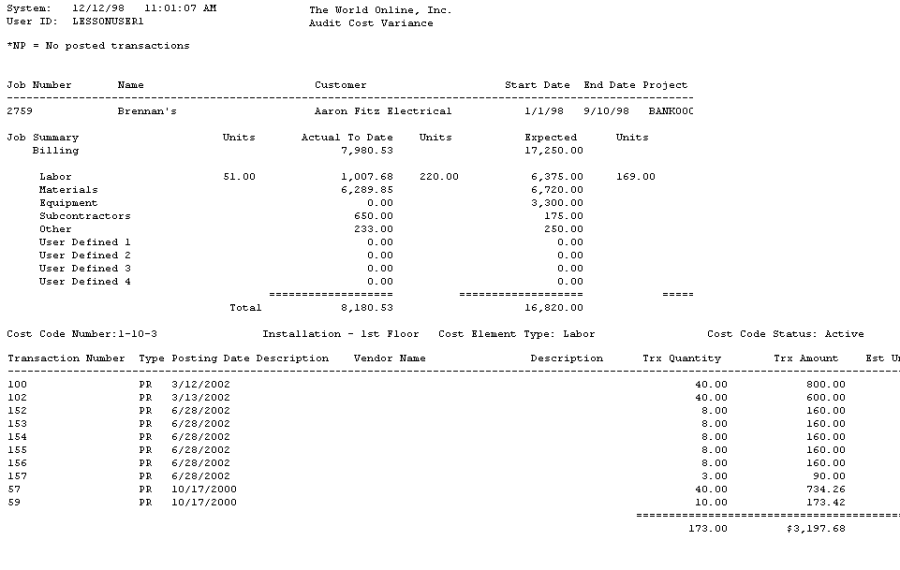

The Audit Cost Variance report shows detailed transaction information for a job with estimate variances by cost code and cost element. The variance is between the expected costs and actual costs.

-

Select Reports > Job Cost > Job Reports > Audit Reports > Audit Cost Variance.

-

Select a Job Number Range radio button. If you select Job Number, select a Job. If you select Range, enter a Range.

-

Select a Date Range radio button. If you select Range, enter a Start Date and End Date.

-

Select a Range radio button and enter a cost element type or cost code.

-

You can mark the Exclude Inactive checkbox to exclude inactive cost codes from the report.

-

Select Print.