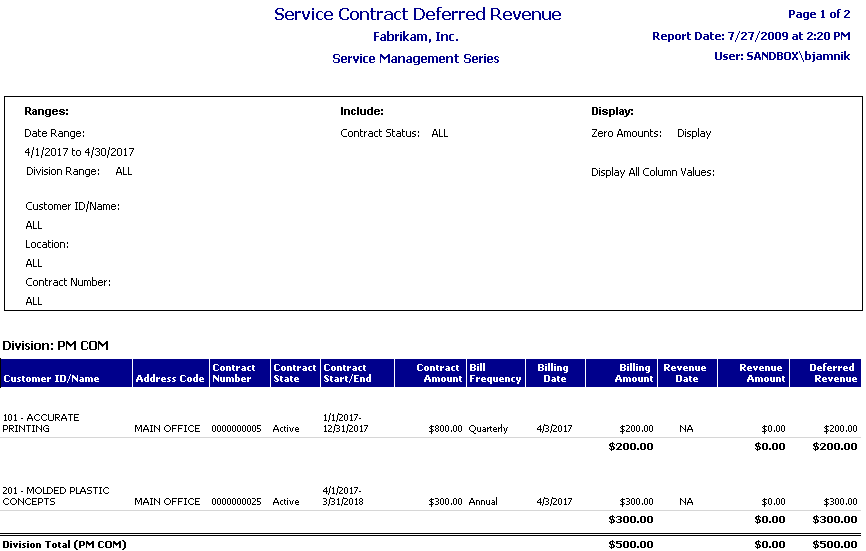

This report summarizes the amount of deferred revenue for a maintenance contract that uses the Revenue Schedule method of revenue recognition. You can compare the amount of revenue that has been recognized to the amount that a customer has been billed, as well as view revenue that will be recognized in the future. You can also compare the financial details of the contracts in this report to the balance in the General Ledger Deferred Revenue account during reconciliation. When a preventative maintenance invoice is generated, the Progress Billing or Deferred Revenue account is credited. The account is debited when revenue is recognized.

You can view these transactions by contract or account, and this report can be compared to GL activity on the Summary Inquiry window (Inquiry > Financial > Summary). If the Net Change for a GL account does not match the transaction detail on this report, the exception reports GL Transactions Not in Service and Service Transactions Not in GL can help you identify issues in Progress Billing accounts, as well as any account that is set up for any division in Maintenance Accounts setup. This report can only be printed from Report Manager or the Custom Reports list and can be filtered by date, customer, location, contract number, division, and contract status.