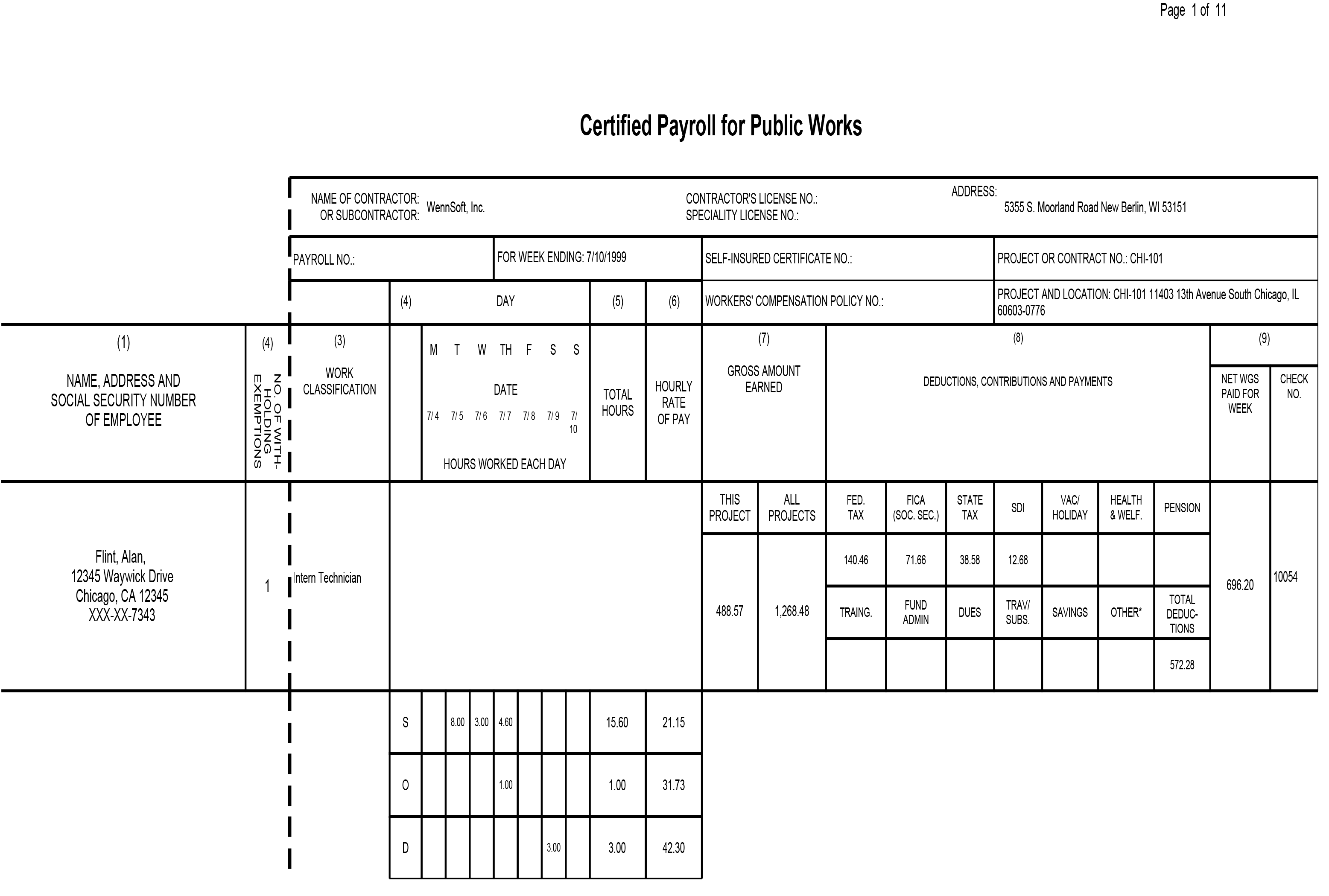

The Certified Payroll for Public Works report allows you to provide weekly documentation of the hours worked and wages earned by your employees. This report meets the requirements for reporting payroll information for public works projects in the state of California. This report contains a certification form, employee information such as withholding exemptions, work classification, and social security number, the total hours for the week, hourly pay rate, gross amount earned, any deductions, contributions, and payments, and net wages paid.

Note the following information for using this report:

-

In California, you are required to report state disability insurance (SDI).

-

For SDI amounts to display correctly on the report, your local state disability insurance tax code must be named "SDI."

-

FICA social security amounts and FICA Medicare amounts are combined in the FICA social security box.

-

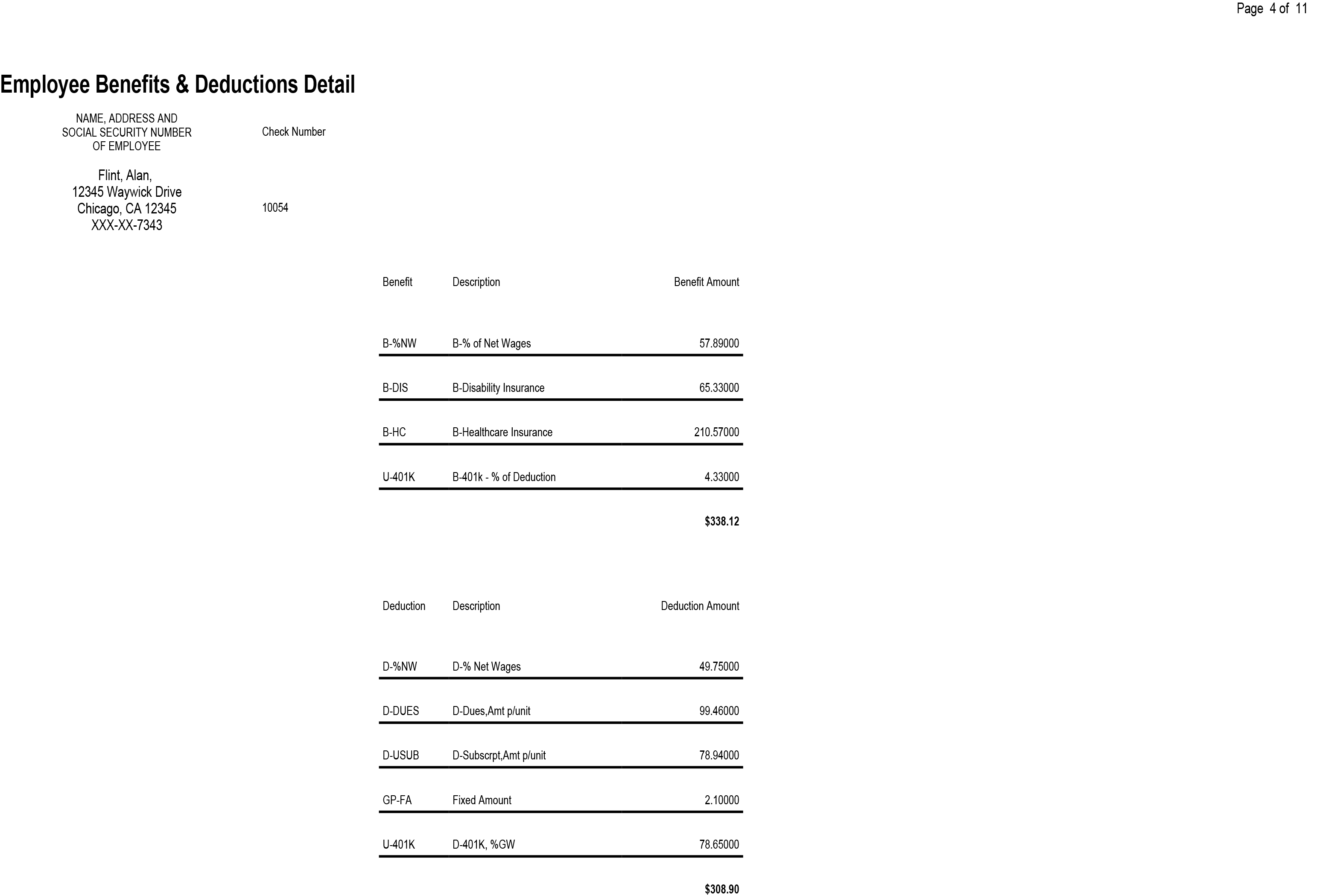

Other deductions and payments are listed separately.