When processing payroll with union rate classes, perform the following steps.

-

Set up rate classes in Job Cost. See Setting up Rate Classes for Union Payroll.

-

Enter payroll transactions. See Entering Payroll Transactions in Job Cost.

When processing payroll with rate classes, consider the following:

-

-

If you are posting payroll transactions on daily, when you calculate checks, benefits/deductions will only be calculated for one day instead of five. Therefore, when using rate classes, you cannot run Job Cost Posting daily; only once a week.

-

Rate classes work only with the Microsoft Dynamics GP Payroll and Signature TimeTrack modules.

-

You can enter/change the rate class when entering payroll transactions. This change affects only that transaction.

-

When building payroll checks, make sure to include benefits and deductions in the calculations.

-

Rate classes work only with Job Cost labor cost elements.

-

When entering payroll transactions, do not enter a rate class for non-union employees.

-

You can assign a rate class to a labor transaction in TimeTrack. See "Entering labor transactions" in the TimeTrack User Manual for more information.

-

Example Rate Class Scenarios

This section includes example scenarios on how you can use rate class to satisfy your complex union payroll needs. The first example takes you through from setup to calculating payroll checks (including sample windows), and show how the system calculates your payroll based on the setup criteria given. The remaining examples illustrate additional combinations of rate classes.

Example 1: Employee works on a heavy commercial job as a temporary Foreman

In this example, an employee, ALAN FLINT, works on a heavy commercial job as part of union Local 7 - Pipefitters in Milwaukee. His job title (position) is normally Journeyman, but on this job, he is Foreman.

FLINT's normal pay rate, as set up in his employee record, is $27.00/hour. Conversely, a Foreman's general pay rate is $37.00/hour. But because a) ALAN is going to be a temporary Foreman on this job, and b) the pay rate increases to $40.00/hour for a Foreman on heavy commercial jobs, the system needs to determine ALAN's payroll at the adjusted rate; that rate will be set up as a rate in Rate Class setup.

ALAN's company will set up their rate class by location/job type.

Step 1: Set up Rate Classes

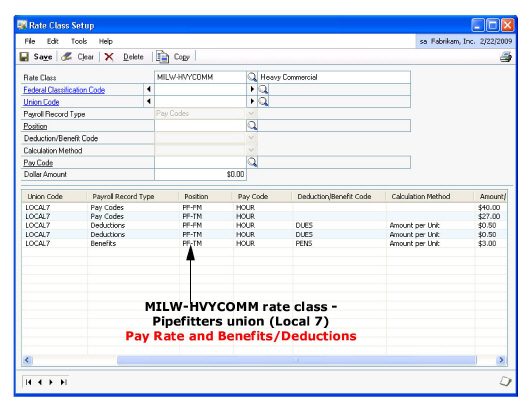

In this step, we will set up a rate class called MILW-HVYCOMM. Sample data used is summarized below, followed by sample screen shots.

Microsoft Dynamics GP > Tools > Setup > Job Cost > Payroll Setup > Rate Class. The Rate Class Setup window opens.

-

Rate Class: MILW-HVYCOMM

-

Union Code: Local7

-

Position: Pipefitter Foreman

-

Deduction Code: DUES (union dues) = $0.50/unit

-

Benefit Code: PENS (pension) = $3.00/unit

-

Pay Rate: $40.00/hour

See the sample screenshots below:

Rate Class Setup

All we had to do here is set up a rate class with the appropriate union/pay rate/etc. combination; nothing needed to be changed at the employee record level (then subsequently changed back again). We set up a pay rate for a Journeyman and Foreman, to illustrate the difference.

When ALAN goes back to being a Journeyman, his pay rate, deductions, benefits, and so on, will be calculated based on the conditions at that time. On his next job, he might be a Journeyman again, and his pay rate could come from his employee record, or if driven by the job, another rate class could be set up then.

Step 2: Assign Rate Class MILW-HVYCOMM to the HVYCOMM Job

In this step, we will assign the rate class MILW-HVYCOMM to a job called HVYCOMM. This will allow us to apply the correct payroll costs (based on rate class and union) to the job.

Cards > Job Cost > Job. The Job Maintenance window opens. Select the job. In the Rate Class field, select the MILW-HVYCOMM rate class. Because multiple unions are assigned to this rate class, you will select the union when entering payroll transactions for each employee.

Step 3: Create Payroll Transactions for ALAN

In this step, we will create payroll transactions for ALAN. In this example, we will create the transaction using the TimeTrack Time Card Entry window. When you select the job, the pay rate as specified with the MILW-HVYCOMM rate class will automatically fill into this window.

In addition, because ALAN is classified as a Pipefitter Journeyman, but instead is a Pipefitter Foreman on this job, you must edit the Position code for each transaction (using the expansion button next to the Pay Code field to open the Edit Payroll Fields window).

-

Batch: HVY-COMM

-

TRX Type/Cost Type: JOB COST

-

Job Number: HVYCOMM

-

Cost Code: 00-1000-001

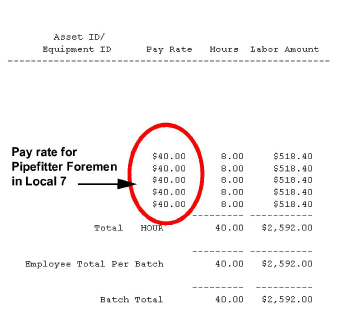

After creating transactions, save and commit the batch. A snapshot of part of the Signature Time Card Commit report displays below.

Because we can change the Position during payroll transaction entry, we do not affect the employee record at all; ALAN is still classified, by default, as a Pipefitter Journeyman.

Step 4: Build Checks

Transactions > Payroll > Build Checks. Select the batch, then select Post.

Step 5: Calculate Checks

Transactions > Payroll > Calculate Checks. The Calculate Payroll Checks window opens. Select OK to begin the calculate process.

Step 6: Post Payroll Transactions to Job Cost

In this step, we will post the payroll transactions for ALAN using the Signature Payroll Post feature.

Transactions > Payroll > Signature Payroll Posting. The Signature Payroll Post window opens. Select the appropriate batch.

What is Posted to Job Cost?

You can view posted costs that include rate class pay rates, deductions, and so on, just as you would any payroll transaction,

Inquiry > Job Cost > Job Status. The Job Status window opens.

Drill down all the way to the Payroll Entry Zoom window (Drill on Posted Costs, Cost Code, Actual Cost Amount, double-click a transaction).

Zoom on the posted costs amount until you reach the Payroll Transaction Summary window. This window shows a breakdown of costs posted. The window below shows a breakdown of costs for our fictitious employee ALAN.

Gross wages = $320.00 ($40 * 8)

Overhead calculation:

Benefit - $6 * 8 hours = $48.00

Burden - $10 * 8 hours = $80.00

ETax – 15% of $320.00 = $48.00

W/C – 7% of $320.00 = $22.40

Total overhead amount: $198.40

Total amount applied to the job: $320.00 + $198.40 = $2,592.00 ($518.40 * 5)

Example 2: Two employees work on the same job, each with his own union (one a Pipefitter, the other an Asbestos worker). They both work in Milwaukee on a light commercial job, and are assigned to the same rate class.

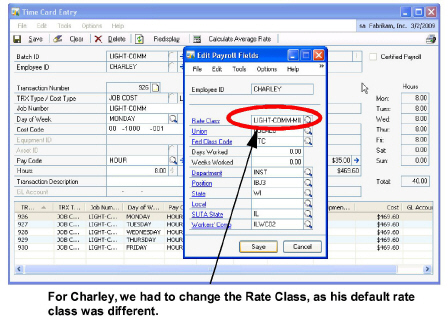

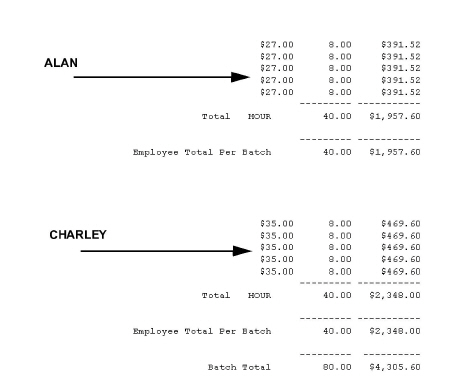

In this example, our fictitious employees, ALAN FLINT and CHARLEY NICK, work on the same job in the same week. ALAN is back to being a Journeyman Pipefitter, and is classified as such on this job. CHARLEY is an Asbestos Journeyman Class II.

ALAN's pay rate is $27.00/hour.; CHARLEY's is $35.00/hour. In addition to the pay rates being different, their benefits and deductions also vary between the two positions.

Step 1: Set up Rate Classes

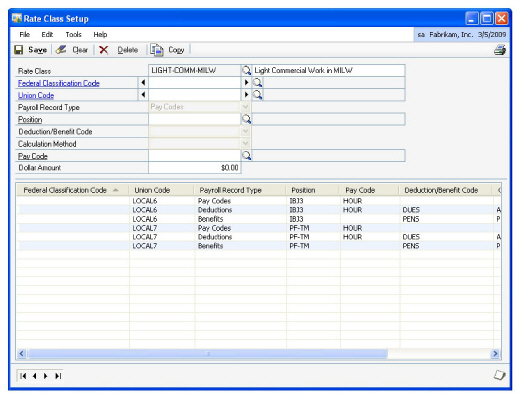

In this step, we will set up a rate class called LIGHT-COMM-MILW. Sample data used is summarized below, followed by sample screen shots.

Microsoft Dynamics GP > Tools > Setup > Job Cost > Payroll Setup > Rate Class. The Rate Class Setup window opens.

-

Rate Class: LIGHT-COMM-MILW

-

Union Codes: Local7 and Local6

-

Positions: PF-TM (Pipefitter Journeyman) and IBJ3 (Asbestos Journeyman Class II)

-

Deduction Codes: DUES (union dues) = $0.75/unit and .0.85/unit

-

Benefits: PENS (pension) = 3% of gross wages for both unions.

-

Pay Rates: $27.00/hour and $35.00/hour

Rate Class Setup

Step 2: Assign Rate Class LIGHT-COMM-MILW to the LIGHT-COMM Job

In this step, we will assign the rate class LIGHT-COMM-MILW to a job called LIGHT-COMM (for light commercial work). This will allow us to apply the correct payroll costs (based on rate class and union) to the job.

Cards > Job Cost > Job. The Job Maintenance window opens. Select the job. In the Rate Class field, select the LIGHT-COMM-MILW rate class. Because multiple unions are assigned to this rate class, you will select the union when entering payroll transactions for each employee.

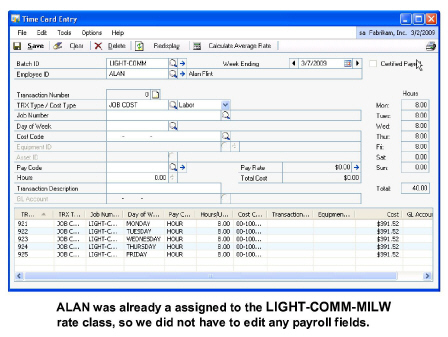

Step 3: Create Payroll Transactions for ALAN and CHARLEY

In this step, we will create payroll transactions for ALAN and CHARLEY In this example, we will create the transaction using TimeTrack Time Card Entry window. When you select the job, the pay rate as specified with the LIGHT-COMM-MILW rate class will automatically fill into this window. After, we will save and commit the batch.

Step 4: Build Checks

Transactions > Payroll > Build Checks. Select the batch, then select Post.

Step 5: Calculate Checks

Transactions > Payroll > Calculate Checks. The Calculate Payroll Checks window opens. Select OK to begin the calculate process.

Step 6: Post Payroll Transactions to Job Cost

In this step, we will post the payroll transactions for ALAN using the Signature Payroll Post feature.

Transactions > Payroll > Signature Payroll Posting. The Signature Payroll Post window opens. Select the appropriate batch.

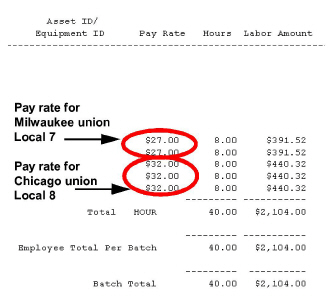

Example 3: Employee works on two jobs in one week, at two different locations, for two different unions, two rate classes

In this example, our fictitious employee, ALAN FLINT works on two different jobs in the same week, for two different union locals. On both jobs, he is classified as a Journeyman Pipefitter.

The first job is in his home union local, Milwaukee. He will be receiving his regular pay rate of $27.00/hour. The second job is in Chicago, and the Pipefitters union there pays their Journeyman at $32.00 per hour; ALAN will be receiving that higher rate while on the Chicago job. In addition, ALAN's benefits will change with the Chicago union local, which he will inherit for the period within which he is on that job.

ALAN's company must set up the rate class feature to account for that higher pay rate in Chicago. We could set up a new record that covers the Chicago union in the existing rate class: MILW-HVYCOMM. However, because we have organized rate classes by location-job type, we will set up an entirely new rate class for Chicago, as ALAN's company will be doing a lot of work there over the next year.

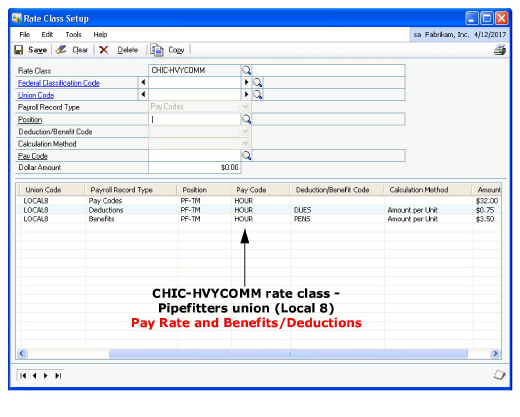

Step 1: Set up Rate Classes

In this step, we will set up a rate class called CHIC-HVYCOMM. Sample data used is summarized below, followed by sample screen shots. In addition, this example will also use the MILW-HVYCOMM rate class that was used in Example 1.

Microsoft Dynamics GP > Tools > Setup > Job Cost > Payroll Setup > Rate Class. The Rate Class Setup window opens.

-

Rate Class: CHIC-HVYCOMM

-

Union Code: Local7

-

Position: Pipefitter Foreman

-

Deduction Code: DUES (union dues) = $0.75/unit

-

Benefit Code: PENS (pension) = $3.50/unit

-

Pay Rate: $32.00/hour

-

Rate Class: MILW-HVYCOMM

-

Union Code: Local7

-

Position: Pipefitter Foreman

-

Deduction Code: DUES (union dues) = $0.50/unit

-

Benefit Code: PENS (pension) = $3.00/unit

-

Pay Rate: $40.00/hour

Rate Class Setup

Although we decided to create an entirely new rate class name, because of the Chicago location, you can organize your rate class hierarchy any way you want. For example, instead of by location and type of job, we could have set it up only based on the type of job, for example, light vs. heavy commercial jobs, and so on.

Step 2: Assign Rate class CHIC-HVYCOMM to the HVYCOMM-CHIC Job

In this step, we will assign the rate class CHIC-HVTCOMM to a job called HVYCOMM-CHIC. This will allow us to apply the correct payroll costs (based on rate class and union) to the job.

Cards > Job Cost > Job. The Job Maintenance window opens. Select the job. In the Rate Class field, select the CHIC-HVYCOMM rate class. Because multiple unions are assigned to this rate class, you will select the union when entering payroll transactions for each employee.

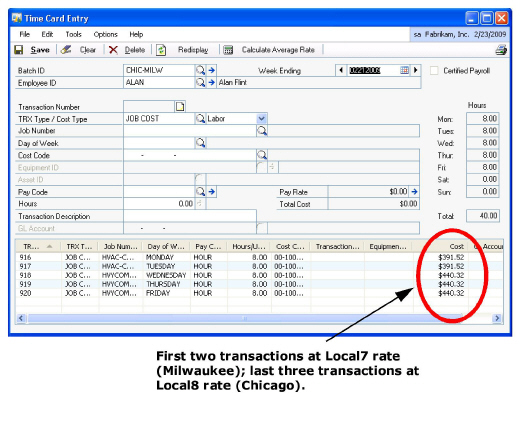

Step 3: Create Payroll Transactions for ALAN

In this step, we will create payroll transactions for ALAN. In this example, we will create the transaction using TimeTrack Time Card Entry window. ALAN is working in Milwaukee on Monday and Tuesday, then in Chicago on Wednesday through Friday.

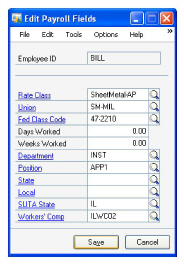

The first two transactions will use the HVYCOMM job, MILW-HVYCOMM rate class, and the Local 7 union; the last three transactions will use the HVYCOMM-CHIC job, CHIC-HVYCOMM rate class, and the Local 8 union. The position will be PF-TM (Pipefitter Journeyman) for all transactions. We must edit some fields (using the expansion button next to the Pay Code field to open the Edit Payroll Fields window).

A summary of the data entry values appears below:

-

Batch: HVY-COMM

-

TRX Type/Cost Type: JOB COST

-

Job Number: HVYCOMM

-

Cost Code: 00-1000-00

-

Rate Class: MILW-HVYCOMM

-

Union Code: Local7

-

Batch: HVY-COMM

-

TRX Type/Cost Type: JOB COST

-

Job Number: HVYCOMM-CHIC

-

Cost Code: 00-1000-00

-

Rate Class: CHIC-HVYCOMM

-

Union Code: Local8

After creating transactions, save and commit the batch. A snapshot of part of the Signature Time Card Commit report appears on the next page.

Step 4: Build checks

Transactions > Payroll > Build Checks. Select the batch, then select Post.

Step 5: Calculate Checks

Transactions > Payroll > Calculate Checks. The Calculate Payroll Checks window opens. Select OK to begin the calculate process.

Example 4: Employee works on a job for a different union local, and has been approved to get paid the higher rate, which happens to be his home union local

This example uses TimeTrack for payroll transactions.

Employee, WILLIE GREEN, is working on a job for the Sheet Metal Local Appleton union. His home union is Milwaukee, and he is performing the same duties in Appleton as does in his home union. In spirit of reciprocity, the Appleton local has agreed to pay Willie his home rate, which is the higher rate of the two unions.

For purposes of this example, we will assume that the User higher pay rate checkbox has been marked for all rate classes in the Job Cost system. This example uses TimeTrack.

Pay rates:

Our fictitious system is set up with the following pay rates:

Job pay rate (from a rate class assigned to job): $23.45/hour

Home union pay rate (from a rate class assigned to employee): $26.75

Pay code pay rate: $20.00

Transaction:

We will create TimeTrack transaction for WILLIE GREEN and show that the system will use the highest pay rate of the three:

The Pay Rate filled correctly with $26.75.

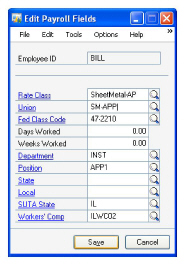

In the Edit Payroll Fields window (expansion button in Pay Code field), the Rate Class fills from the job, and the Union from employee. Because the rate class and union code for Willie's union differ from the Milwaukee union, we must change the union.

After changing the union. the window looks like this:

If you create more transactions for this job, and the unions differ, you must change the Union field in the Edit Payroll Fields for every transaction.