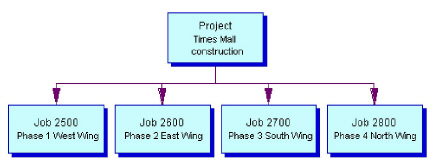

Projects are used to group and track related jobs. You can assign multiple jobs to a project and print reports by project number. The diagram below illustrates a sample project. Projects are used primarily with project-level billing. If you do not use project-level billing, you do not have to set up projects. See also Setting up Project-Level Billing.

To create a project:

-

Select Cards > Job Cost > Project to open the Project Maintenance window.

-

Complete the following fields, as necessary.Project Number, DescriptionYou must enter a number and description for the project.ManagerUse the lookup to select a project manager.Customer Number, AddressSelect the project customer and address.Bill To Customer, Bill To AddressThis field defaults from the Customer Number and Address fields. You can select a different Bill To Customer for third-party billing. If you select a different customer, the Bill To address defaults from the Customer Maintenance window, however you can select a different address.Tax ScheduleThe tax schedule defaults from the customer record. If a tax schedule is assigned to the job address, the job address tax schedule overrides the customer tax schedule. You can use the lookup to select a different tax schedule.Project TypeSelect one of the following. Once a project has been saved or has posted jobs, you cannot change the project type.Project Standard BillingProject Bill CodeYou can use this project type ONLY if all jobs assigned to the project have a billing type of Project Bill Code.Cost Plus BillingUse this project type for Time and Materials (T&M) projects.Project Allocated RevenueUse this project type for a Fixed Contract project.Architect IDSelect an architect ID if you want to assign an architect to the project.Calculate Sales Tax on Billing AmountIf you are using a Retention Percent, mark this checkbox to calculate the sales tax on the Billing Amount. If unmarked, the sales tax is based on the subtotal amount (Billing Amount - Retention Amount). There are currently five states (WA, NV, TX, OH & DE) that require that sales taxes on the Job Cost invoices be calculated based on the gross receipts (sales amount not reduced by retention). The Calculate Sales Tax on Billing Amount checkbox displays on the Project Invoice Entry window as well, with the checkbox defaulting based on the Project from the Project Maintenance window. Users can mark/unmark the checkbox in the Project Invoice Entry window. Taxes are recalculated when the checkbox is marked/unmarked. Total to Allocate (read-only)This field displays the project's contract amount, or the sum of the contract amounts for all jobs assigned to this project. If you are using the Project Allocated Revenue billing type, this field indicates the total amount that will be allocated by bill code.Total Reimbursable (read-only)This field displays the total billable amount generated by any reimbursable jobs assigned to this project. If no reimbursable jobs are assigned to the project, this amount is zero.

-

Enter additional project information as necessary.

-

To print the Project Number Setup report, select File > Print or select the printer button.

-

Select Save.