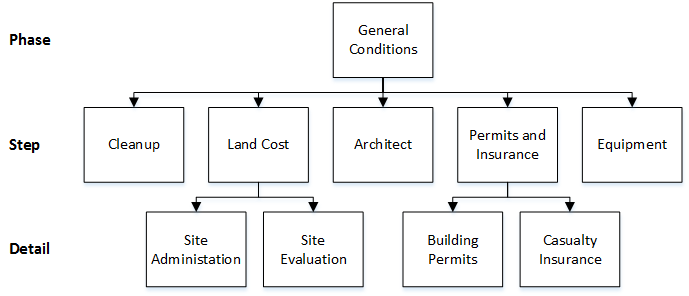

Cost codes define the cost category and cost amount for a job. You add cost codes in the Job Cost Codes Setup window. You can break a job into phases, steps, details, and even sub details. A step can be broken into categories or cost elements such as labor, material, equipment, subcontractors, and miscellaneous costs.

In the example above, the General Conditions phase relates to the initial acquisition of land for a home or commercial building job. The phase is broken into the cost of land, cleanup, architectural fees, etc. Job detail is tracked for two of the steps. Each phase, step, detail, and sub detail of a job can be assigned an alphanumeric code or cost code for tracking purposes.

/*<![CDATA[*/ div.rbtoc1772637622630 {padding: 0px;} div.rbtoc1772637622630 ul {list-style: disc;margin-left: 0px;} div.rbtoc1772637622630 li {margin-left: 0px;padding-left: 0px;} /*]]>*/ Adding Cost Codes to a Job Revising Estimated Costs

Adding Cost Codes to a Job

-

Select Cards > Job Cost > Job.

-

Select a Job, then select the Cost Codes button.

-

Use the lookup to select a Cost Element Type. Entering a cost element type causes the lookup window for the Cost Code field to include only codes for that cost element. The default is 1 for Labor.

-

Use the Add Cost Codes button to enter an existing master cost code or enter a new cost code and description.

The lookup for the Cost Code field applies only to cost codes that have already been added to this job. It is not a lookup for the Master Cost Codes Setup window. The Posted To checkbox is marked if transactions have been posted for the cost code and job. The Added by CO checkbox is marked if the cost code was added through a change order.

-

Enter the Profit Type ID and Profit Amount. These fields will be disabled if the contract type is Fixed Amount. The profit amount can be a flat dollar amount or percentage. Choices depend on the contract type of the job. The default is 2 - None. Profit type 9 is available when the cost element type is Labor. See Description of Profit Types.

If the contract type is:

Profit type choices are:

Fixed Amount

2 - None

Cost Plus or Cost Plus NTE

1- Non-Billable

2 - None

3 - Percent Margin

4 - Percent of Cost

5 - Per Unit Amount

6 - Total Dollar Amount

7 - Flat Rate per Cost Code

8 - Flat Rate per Unit

9 - Service Labor Rate Group

-

Complete the remaining fields, as necessary.Service Labor Rate Group This field is enabled only if the profit type is 9 - Service Labor Rate Group. See Creating Labor Rate Groups for Job Cost (Optional).Account Number If you're using the Division posting option, an account number automatically appears. If you're using the Cost Codes posting option, you must enter an account number.Project Manager The name of the project manager comes from the Employee Maintenance window.Estimate Units If you are using the Estimate Cost by Period posting option, this field is disabled.Estimate Amount / Unit Enter the estimate amount per unit of measure. If you are using the Estimate Cost by Period posting option, this field is disabled.Estimate Amount This amount calculates based on what you entered in the Estimate Units and Estimate Amount/Unit fields. If you are using the Estimate Cost by Period posting option, you must select the "+/-" button to enter an estimate. See Revising Estimated Costs below.Estimate Measure Use the lookup to select an estimate measure type, for example, EA (each) and HR (hours).Estimate Measure Name After completing the estimate measure field, the Estimate Measure Name populates from the description in the Measure Setup window. This field cannot be changed.Track Production Qty. Mark this checkbox to enable the Production Est Quantity and Production Measure fields.Production Est Qty., Production Measure Enter production information. These fields are used to track the amount of work and material used for this cost code.Production Qty. / Unit, Production Measure Name These fields are system-generated, based on the production information you entered above.Start Date, Completion Date Enter a start date and completion date.Workers Comp. Use the lookup to select a workers' compensation code.Revenue Code Displays the revenue code that the cost code is assigned to. For more information, see Assigning Cost Codes to Revenue Codes.Transaction Type This field is enabled only for cost elements other than Labor. Select a transaction type from the drop-down list; choices include ALL, Inventory Item, Vendor ID, and Purchase Order.If you select Vendor ID, you can enter a vendor to link the Cost Code to a subcontractor. See Using the Subcontractor Feature.If you select Inventory Item, an Item Number field appears, allowing you to enter an inventory item. If you select Purchase Order, a PO Number field appears, allowing you to enter a purchase order number. These two fields are informational only and do not affect the job.Inactive Mark this checkbox to inactivate the cost code. Inactivating a cost code prevents additional costs from being posted. This is useful when the phase of a job that is associated with the cost code is finished. You cannot enter the following transactions for an inactive cost code: inventory, sales order processing, purchase order processing, payables, Microsoft Dynamics GP Payroll, Job Cost (except production and unit adjustment), and TimeTrack. You can post a receivings transaction only if the cost code was marked as inactive after the purchase order transaction was posted and before the receivings transaction is posted. You can also enter production unit transactions and job transaction unit adjustments for inactive cost codes.

-

Select Save.

-

To print the Job Cost Codes setup list, select File > Print or select the printer button.

Revising Estimated Costs

You can enter estimate cost revisions and cost estimates based on fiscal periods for cost codes on a job. If a change order has been created for the cost code, you cannot edit the cost code estimate. You can revise estimated costs in flat dollar amounts or in units. You may need to revise the estimates if you import estimates from an integrated software application or enter them in the Job Cost Code Setup window. Revising an estimate on a cost code overrides the original estimate assigned to the cost code unless you are using the Estimate Cost by Period posting option.

When you enter an estimate revision and are using the Estimate Cost by Period posting option, make sure the posting date falls within the period you want the transaction to affect.

-

Select Cards > Job Cost > Job.

-

Select a Job, then select the Cost Codes button.

-

Select the +/- button in the Estimate Amount field.

-

Enter the Cost Code.

-

Enter the number of Units and an Amount/Unit. If you entered a single Unit ("1"), the Amount/Unit is a flat dollar amount that will default in the Amount field. If you entered multiple units, the total estimated cost code amount calculates automatically as the Amount.

-

Enter a Description.

-

Select Post. The estimate information is displayed in the scrolling field. The Transaction Total field appears if you have the Estimate Cost by Period checkbox marked in the Posting Options window.

-

To print the Estimate Revision List report, select File > Print. Close the Estimate Cost Revision Entry window.

-

Select Save. The Job Cost Codes Setup window reappears. After you post an estimate revision, the amount appears in the Estimate Amount field in the Job Cost Codes Setup window. You can zoom on this amount to display the Cost Code Estimate Zoom window, which summarizes the estimate information entered.