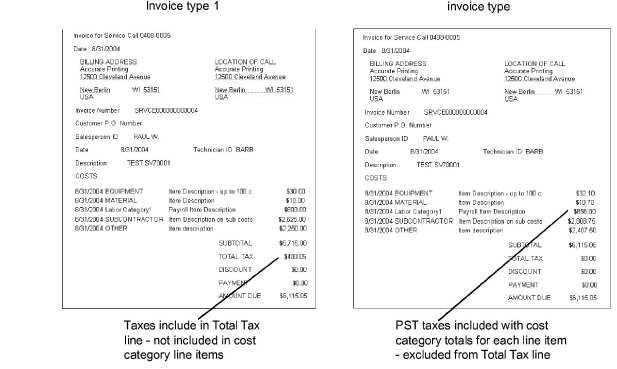

The PST invoice is a new invoice that includes "tax on costs" and tax that is taxable. Tax amounts are distributed back to the customer by being included in the billing totals for the cost categories. Only taxes on billing amounts appear in the Tax Total field on the invoice. You can generate PST invoices in Service Management using a special invoice type. PST is tax on cost. This tax is often paid by the company, then collected by charging the tax back to the customer as a taxable tax. With this feature, committed costs will be included in the actual costs when calculating tax amounts. Taxes will be calculated based on cost amounts, not billing amounts. In addition, this tax will be included in the line item for the appropriate billing cost category - not in the Total Tax field on the invoice. Before you begin, make sure the appropriate tax schedules and other tax information are set up for PST.

/*<![CDATA[*/ div.rbtoc1772637621746 {padding: 0px;} div.rbtoc1772637621746 ul {list-style: disc;margin-left: 0px;} div.rbtoc1772637621746 li {margin-left: 0px;padding-left: 0px;} /*]]>*/ Differences Between PST and Non-PST Invoices Setting up PST Invoicing Creating PST Invoices

Differences Between PST and Non-PST Invoices

The PST invoice format is based on the default Invoice 1 service invoice format. A sample of each invoice type appears below, including a comparison.

Setting up PST Invoicing

To set up PST invoicing, you must enable the system to use the new PST invoice format.

-

Select Microsoft Dynamics GP > Tools > Setup > Service Management > Invoice Setup > Invoice Options.

-

Mark the Enable PST Invoice Format checkbox.

-

Select OK.

Creating PST Invoices

You create a PST invoice using the Service Invoice window by selecting the PST Invoice format.

-

Select Cards > Service Management > Service Manager.

-

Select a customer and select the History indicator.

-

Double-click a call and select the Invoice button. The Service Invoice window opens.

-

Complete this window as you normally would.

-

Select the Print button.

-

Select PST Invoice from the list of invoice types.